2 The Five Principles of Finance

2.1 Introduction

At the end of this chapter, you will be able to:

- explain why money has a time value

- explain the trade-off between risk and return

- explain why cash flows are the source of value

- explain why market prices reflect information

- explain the implications of the fact that Individuals respond to incentives

- apply the five principles of finance to financial decisions.

You may be familiar with “AfterPay”, a product of the Australian listed company AfterPay Touch Group Ltd. AfterPay is a financial product that allows consumers to “buy now and pay later”, with no financing costs.

Don’t just pay later. Pay Better. Choose Afterpay (YouTube, 15s):

Did you ever wonder how AfterPay Touch makes money from AfterPay?

Or why retailers participate?

2.1.1 How the AfterPay business model works

Here’s how AfterPay works from the customer’s perspective, buying a product of $100 using AfterPay:

You pay ¼ (=$25) of the price when you buy your item(s) from a participating retailer, and ¼ more every fortnight for a total of 4 payments (now, in 2 weeks, in 4 weeks and the final payment in 6 weeks). No fees or charges as long as your payments are all on time. Late fees start at $10, with a maximum of up to $68 (depending on the amount of your purchase).

And this is what it looks like for the retailer: The participating retailer receives 96% of the purchase price on the day of purchase. That is, they essentially pay AfterPay 4% of the purchase price for the ability to offer AfterPay to their customers. On a $100 purchase, AfterPay is out-of-pocket $71 on the day of purchase (they pay the retailer $96 and receive $25 from the purchaser), and receive three fortnightly payments of $25. Based on the computations we’ll learn later in the course, this equates to a 2.8% return per fortnight for AfterPay (you will learn how to calculate this in Chapter 4), and an annualised return of over 100%.

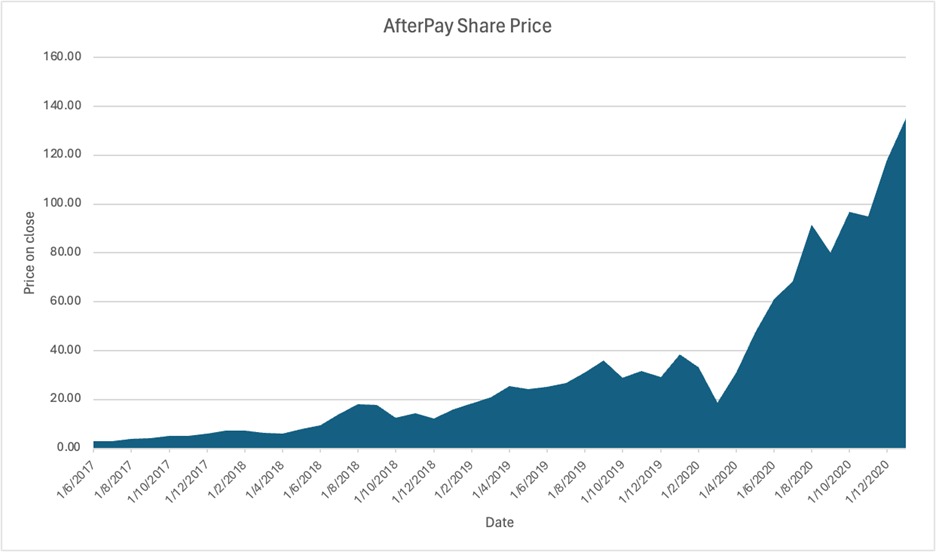

Of course, AfterPay has many costs to pay out of that return, so the net return to AfterPay Touch shareholders is significantly less than this. Even so, 26 months after listing on the ASX, the share price had risen from under $3 to over $30, meaning investors have great confidence in AfterPay’s future. This confidence has continued, with AfterPay’s share price at $135.87 on the 1st of Feb 2021 (simply google AfterPay stock and you can see the share prices).

So, as a financial manager, how would you analyse the business model of AfterPay?

So, as a financial manager, how would you analyse the business model of AfterPay?

One way to organise your analysis is to consider the five principles that underlie all financial decision making:

- Money has a time value.

- There is a trade-off between risk and return.

- Cash flows are the source of value.

- Market prices reflect information.

- Individuals respond to incentives.

In this chapter, we will explore each of these principles and what they imply with regard to the financial behaviour of individuals and businesses.

2.2 Why Money Has a Time Value

Would you rather have $100 today or $100 a year from now?

Most people would rather have the money now rather than later. So, to induce people to defer receipt of money to the future, more money must be offered in the future than today. How much more will depend on what you can do with the money in the interim. Most would prefer $200 in one year to $100 today, but is a guaranteed $105 in one year enough for you to be willing to give up $100 today?

Watch the following video for an explanation of how money has a time value.

VIDEO: Time Value of Money Explained (YouTube, 2m48s)

The fact that money has a time value means that timing is an important attribute of cash flows. You can only compare cash flows directly if they occur at the same point in time.

If cash flows are at different points in time, then they must be adjusted using the time value of money formulas to move them all to a single point in time. This concept underlies most of the computations we will do in this course, from figuring out the value of shares to evaluating new products and other financial projects.

When considering the AfterPay business model, the proposition to the customer depends heavily on time value of money – the customer is able to defer payment for up to 6 weeks at no cost. As you will learn in this course, the option to delay payment is generally beneficial to the customer, assuming the customer has an opportunity cost of greater than 0%.

We’ll learn more about the time value of money in Chapters 3 and 4.

2.3 Trade-Off Between Risk and Return

Imagine you’re a contestant on a TV game show. You must choose between two boxes – one box has $1000 in it and one is empty, but you don’t know which is which. Before you choose, what is your “expected” outcome – that is, what is the average amount that you will receive?

Your expected outcome is $500 because you have a 50% chance of receiving $1000 and a 50% chance of receiving nothing. Mathematically, your expected outcome is the sum of each possible outcome multiplied by the probability of that outcome:

$500=50%×$1000+50%×0

Does that mean that you will get $500? No. You’ll get either $1000 or zero. This is a risky outcome. In other words, you don’t know how much you’ll receive, but on average you’ll get $500.

All business investment involves risk.

You might have a great idea for a new business venture, but there are no guarantees that it will be successful. In order to get the business off the ground, you, and everyone providing funding for the venture, must be prepared to take some risk.

Concept Check

Say the price of both investments is $450. Now which one would you buy?

- Investment A

- Investment B

Investment A has more risk than Investment B, but the expected outcome of the two investments is the same:

Investment A: 1000×50%+0×50%=$500

Investment B: 450×50%+550×50%=$500

This means Investment B is a more attractive investment, as most investors are risk averse, and your expected outcome for Investment B is not higher to compensate for the extra amount of risk.

Most investors are risk-averse.

This means that for a given return or expected outcome, they will choose the less risky option. In order to encourage investors to take risks (and not just hide their money in a mattress!), riskier investments have to offer higher average returns (or have lower prices). That is, there’s a trade-off between risk and return. Riskier investments will have higher returns, on average, and safer investments (like bank deposits) will have lower returns.

Different borrowers pay different interest rates – large banks can borrow at the RBA Cash Rate, which was below 1% p.a. (per annum, or annual) in mid-2019; home loan rates at the same time were around 3-5% p.a., and credit card rates were 13-20%p.a. These different rates reflect the risk that the amount lent will not be repaid.

How does this trade-off between risk and return figure into the AfterPay business model?

One way is through the effective interest cost that AfterPay is able to earn: 2.8% per fortnight. This is a very high return, much higher than credit card interest rates which would be equivalent to approximately 0.8% per fortnight. Part of the reason AfterPay can command this higher return is due to the services provided to both retailers and customers. But part of the return is due to the risk of non-payment. At the same time, investors will value AfterPay’s shares depending on the risk of the cash flows (e.g. dividends) they expect to receive.

Of course, some investors are more risk-averse than others. This may have to do with the amount of time they have to recoup any losses. Your grandfather may be retired or near retirement. If he loses half of his money from a bad investment, it will affect his ability to support himself in retirement. On the other hand, a 20-year-old has plenty of time to save for retirement. If they invest their super in high-risk/high-growth assets like shares over the 45+ years until retirement, the higher average/expected return on risky investments means that a year of negative returns will be balanced by high returns in subsequent years.

There are other factors that determine how risk-averse an investor is, such as personal investing history, cultural differences, financial literacy, and occupation.

How risk averse are you?

Take the Investment Risk Tolerance Assessment based on academic research and developed by the University of Missouri.

Concept Check

2.4 Cash flows are the Source of Value

In finance, cash is king!

Cash can be invested in new products or equipment, or distributed to the company’s investors. You might think that profit is more important because profit is what is reported in the company’s financial statements, but can we spend profit?

There are some significant differences between profit and cash flow. The most obvious difference has to do with the way accountants treat investment in fixed assets – things like buildings and machinery. Even though the equipment purchase will probably require a cash outlay immediately, the accountants will spread the costs over the useful life of the equipment. First, the equipment will be recorded on the balance sheet as an asset rather than showing it as an expense on the income statement. Then, over the useful life of the equipment there will be an annual expense for depreciation. However, the firm does not actually spend anything at that point in time. To account for such discrepancies between when cash flows occur and when they are included in profit, we will learn in Chapter 8 how to convert the company’s profit to cash flow. One adjustment we have to make is to add back any depreciation expense and subtract the cash paid for new purchases of equipment.

Cash flow and profit measure different things.

Profit is an assessment of the economic gain to investors from company activity. When the company is liquidated it can sell assets, pay off liabilities, and whatever is left goes to shareholders. If the economic gain is what you’re measuring, then purchasing equipment or land does not represent a loss to the company, and shouldn’t go directly onto the income statement as an expense. But, equipment or land won’t help the company pay next week’s payroll or dividend distributions to shareholders. To continue in business a company must have cash. In finance, we’re measuring the value of a business a bit differently to how accountants measure value. Accountants focus on historical cost and verifiable numbers. In finance we focus on cash flow and when the company has access to cash that can be distributed to shareholders. Cash flow determines the market value of the assets a company owns and ultimately the market value of the company as a whole.

What are the cash flows that create value for AfterPay?

When a customer buys a $100 item, AfterPay pays the retailer $96. AfterPay receives 4 payments of $25 from the customer, earning $4 over the six weeks between the purchase and the final $25 payment. Out of that $4, AfterPay must pay its operating expenses, which would include app programming and maintenance; advertising costs, the cost of tracking customer accounts, financing costs, and salaries of the managers and owners of the business. AfterPay’s profit will not be the same as the net cash flow for several reasons. For instance, AfterPay would be paying cash currently to develop the app and other software tools that create a large part of the value of the business. As this software will provide value for more than the current year, AfterPay does not treat software development as a current expense. Instead, much like physical assets, the value of the software goes onto the balance sheet as an asset and is amortised (equivalent to depreciation but for intangible assets) over the useful life of the software. But, cash is what is needed to pay creditors, salaries, and merchants. Therefore, any computation of the value of AfterPay to investors will focus on cash flow rather than profit.

Exercise

Which are cash flows?

Which of the following amounts represent cash flows?

2.5 Market prices Reflect Information

If cash flows are a source of value, how does that relate to the share market?

For listed companies, the company shares trade on share markets constantly when the market is open. You may be familiar with Woolworths grocery stores. Woolworths Group Limited is traded on the Australian Securities Exchange (ASX). It would not be unusual to see 3 million Woolworths shares change hands during a single day of trading on the ASX. Each investor who buys or sells Woolworths shares must think they are getting a fair price for the shares; if a purchaser thought the market price was too high, they wouldn’t buy; and if a seller thought the market price was too low, they would hold the shares until they thought the market price was fair. That is, each investor has an idea of the value of Woolworths shares (note that the estimated value need not be identical for every market participant). The share market acts as an auction system and transactions occur when buyers and sellers can agree on the value of the shares.

Where does that idea of value come from?

Professional share analysts estimate the value of companies using a variety of methods, but all of them are based on a knowledge of the business. Often the analyst will forecast the cash flows of the business to determine value. Note that the analyst will be using all three of the previous principles of finance in this process:

- Future cash flows will be discounted to take time value into account;

- The risk of the business will be factored into the return required (used as the interest rate to compute a current (present) value);

- Cash flows will be used as a source of value.

To make an accurate forecast, the analyst needs one other ingredient: information about the company, its plans, the market it faces, and the overall economic environment. When valuing Woolworths, the cash flow model will incorporate the effects of competition from Coles and others; consumer confidence in the Australian economy; releases of financial results from Woolworths and its competitors; company announcements about acquisitions, store closures, and many other factors. When any of these inputs change, the estimated value of Woolworths will change. As investors incorporate new information into their assessment of the value of Woolworths, the amount they are willing to pay for Woolworths shares (or the amount they are willing to accept if they are selling) will change – and the market price will change.

On Friday 28 June 2019, AfterPay Touch shares dropped as much as 15% in afternoon trading on the back of news that credit card company VISA was planning to enter the buy now pay later market. News of an unexpected large competitor would have caused shareholders and analysts to reconsider their forecasts of the growth in AfterPay’s market share, which would, in turn, have reduced the forecast cash flows used to value the shares. The entry of such a large player into the market may also have caused analysts to adjust their estimates of the risk or volatility of those cash flows. As we learned earlier, higher risk means higher required returns. Changing the risk assessment will also affect the value as shareholders will pay more for safer cash flows.

So, in general, announcements bring new information to the market and can cause shareholders and analysts to re-evaluate the value of the business. The relevant information is anything that is a surprise. If we expected profit to rise by 5% and profit does rise by 5%, then there’s nothing new to incorporate into our forecasts, and share price should not change. On the other hand, if we expected profit to rise by 5% and it only rises by 3%, then we need to adjust our forecast cash flows downward, and our estimate of the value of the company will fall. There are many relevant pieces of information when it comes to valuing a company, so there are many types of announcements that could change the value of a company.

Exercise

Match the events to outcomes

Match the following events to one of three outcomes:

1. Share price likely to RISE

2. Share price likely to FALL

3. NO IMPACT on the share price.

2.6 People Respond to Incentives

The final principle in this chapter is that people respond to incentives. You know from your own life that incentives are powerful (e.g. if you study hard, you will likely get a good job). Incentives come in many forms. You probably work because you get paid (financial incentive), but you may also volunteer at your local sports club because you gain joy from doing so. In a work context, employee incentives can often be categorised as financial and non-financial incentives.

As we discussed in Chapter 1, there are four major theories about what the goal of the company should be, but let’s focus on Shareholder and Stakeholder theory here. Shareholder Theory says the firm exists to benefit only the shareholders, while Stakeholder Theory says the firm should benefit all stakeholders. We’ll cover these theories in more detail in Chapter 12, but for now we want to consider HOW the board of directors (and by extension the shareholders and stakeholders) ensure that the firm is managed to provide value for shareholders first and foremost, or for all stakeholders. What stops managers from managing the company to benefit the managers themselves first and foremost, at a possible cost of the value for others?

Let’s step back a minute and remember how a corporation is structured.

Shareholders provide equity capital for the firm – they each own shares in the firm. The company is a separate legal entity that owns the assets (and is liable for the debts) of the firm.

Shareholders, however, are not involved in the daily business decisions of the firm. The shareholders elect a board of directors (one share = one vote); the board of directors hires the management team (Chief Executive Officer (CEO), Chief Financial Officer (CFO) and others as needed); and the managers are responsible for overseeing the daily operation of the firm.

This question of how to ensure that managers are managing towards the correct goal is an example of a “principal-agent problem”. This problem originates from Shareholder Theory.

Under this theory, managers should be running the firm to maximise the overall benefit to shareholders. Shareholders in this instance are the principals – that is, shareholders are the ones who provided the capital to start the firm and are, through the board of directors, hiring managers to act as their agents in running the firm. But, shareholders don’t know the precise details of how the firm runs, what its plans and strategies are, and what needs to be done on a daily basis to keep the firm not only afloat, but thriving. So, there’s an information asymmetry between shareholders and managers – managers have much better information about their task than shareholders.

How do shareholders make sure that managers don’t take advantage of their better information to steer benefits to themselves rather than shareholders?

The conflict that arises when there is information asymmetry between principals and agents is known as the principal-agent problem. And the solution to this problem lies in our fifth principle – providing the appropriate incentives to managers. What is appropriate depends on what theory of the firm is adopted.

Exercise

POLL: IMAGINE YOU ARE A MANAGER OF A PUBLIC COMPANY. WHAT JOB ASPECTS DO YOU CARE ABOUT?

In answering this question, you needed to reflect on how you would respond to incentives. There are clearly no right or wrong answers – different people respond differently. But what is clear is that you do respond to incentives, and the way the incentives are structured will affect how you respond.

When Tim Cook took over as CEO of Apple in 2011, the board of directors granted him 1 million restricted shares in the company. Under the original deal (modified in 2013), the restrictions would lapse on half of the shares in 2016, and on the other half in 2021 (and Cook would be able to sell the shares).

What incentives does this provide?

With such a large portion of his personal wealth invested in Apple, the idea is that such large share ownership would align his incentives with shareholders. For Tim Cook, these shares are in addition to his annual cash compensation of $15 million in 2018 (PDF, 1.73 MB). Famously, Cook’s predecessor, Steve Jobs, received an annual salary from Apple of $1. As the largest individual shareholder, Jobs’ compensation for running the company consisted entirely of the increase in his wealth as the share price rose.

CEOs have not always been paid such lofty sums. This podcast from Planet Money, When CEO Pay Exploded, looks at the history of CEO pay and one reason (partly tax-related) that CEO pay exploded in the 1990s.

When a manager’s pay is based on accounting measures, then the incentive is for the manager to maximise those measures. If pay is in the form of shares, then the incentive is to maximise share price. So, pay incentives need to be crafted carefully so that the company is incentivising the behaviour that it wants to see.

Most of the discussion so far has been focused on incentives for managers to act in the shareholders’ best interest (=increasing the value of the company). However, as businesses adopt a stakeholder perspective, incentives for managers need to be adjusted accordingly, to ensure value for all stakeholders is created. This is exactly what has been happening in recent years, with Australia now leading the world in ESG (environmental, social & governance)-related pay. Thus, pay is increasingly linked to non-financial outcomes such as benefits to the environment and broader society.

Multiple Choice: Shell

2.7 Summary: Applying the Five Principles

In this chapter we have explored five principles that underlie all financial decisions:

- Money has a time value

- There is a trade-off between risk and return

- Cash flows are the source of value

- Market prices reflect information

- Individuals respond to incentives

To wrap up the chapter, let’s consider how all five of these principles apply to something that will be relevant to your personal financial decision making: superannuation.

1. Money has a time value

As we will see in the next two chapters, the time value of money means that the longer you save, the greater the impact of compound interest on the value of your savings. The earlier you start saving, the greater your balance at retirement. This is the principle behind the policy to require employers to contribute 9.5% of your salary to a superannuation fund.

2. There is a trade-off between risk and return

Higher risks lead to higher returns. In deciding which investment option to choose for your superannuation, you will be making a trade-off between risk and return. You could choose to invest your superannuation in government bonds, but to get the returns required to grow your savings, you will need to take greater risks. Fortunately, with 40+ years until you retire, your investment has plenty of time to recover from a loss.

3. Cash flows are the source of value

As you will learn in Chapters 5 and 6, the value of the investments in your superannuation will be based on the cash flows generated by those investments – dividends for share investments, and interest for bond investments. And the value of superannuation to you is the cash flows you will receive to support yourself during retirement.

4. Market prices reflect information

Information about future cash flows – or about trends and regulations that will affect future cash flows – will be an input into the valuation of the investments in your superannuation account.

5. Individuals respond to incentives

A major goal of superannuation is to reduce the reliance of retirees on the Age Pension. To do this, the government needs to convince people to save enough to support themselves in retirement. In addition to requiring employers to make contributions to superannuation, the government provides tax concessions to incentivise individuals to make voluntary additional contributions. These incentives include a 15% tax rate on both contributions and earnings inside superannuation (as compared to a progressive tax rate on individual income that ranges from 19% to 45%) and the ability to withdraw income from superannuation after age 60 without paying additional tax. Individuals have responded to these tax incentives so that superannuation investments now total A$2.9 trillion.