8 Airbnb’s offerings beyond space – before, during and after COVID-19

Sarah Gardiner, Griffith Institute for Tourism, Department of Tourism, Sport and Hotel Management, Griffith Business School, Griffith University, Australia

Sara Dolnicar, Department of Tourism, UQ Business School, The University of Queensland, Australia

Please cite as: Gardiner, S. and Dolnicar, S. (2021) Airbnb’s offerings beyond space – before, during and after COVID-19, in S. Dolnicar (Ed.) Airbnb before, during and after COVID-19, University of Queensland DOI: https://doi.org/10.6084/m9.figshare.14204546

Airbnb as an online trading platform facilitator

Airbnb has become synonymous with peer-to-peer accommodation – letting private spaces to tourists on a short-term basis. This narrow characterisation fails to capture the potential of Airbnb as a platform business (Reinhold & Dolnicar, 2017; 2021). Its nature as a platform – combined with the substantial number of network members Airbnb has attracted among both suppliers (hosts) and consumers (guests), a substantial pre-COVID-19 market share of 10% among Australians booking short-term accommodation (Roy Morgan Research, 2018), and Airbnb’s impressive brand recognition (84% likelihood of rebooking among Australians pre-COVID-19; Roy Morgan Research, 2017) – enables Airbnb to expand its activities to trade more than just accommodation. The logical step – and the one best aligned to Airbnb’s positioning – is to trade tourism-related products and services.

Unsurprisingly, therefore, some had predicted – before COVID-19 forced the global tourism industry into hibernation – that Airbnb would develop to become a one-stop shop for a wide range of travel-related services and products, selling “everything a traveller needs, including seats on planes, tours, local transport, travel insurance, travel vaccinations, and other travel-related services” (Gardiner & Dolnicar, 2018: 88-89). Before COVID-19, a number of developments suggested that this evolution was indeed taking place. The most obvious indicator was the following statement by Brian Chesky, one of the founders of Airbnb: “Homes are just one small part of a great journey […] This was the moment we realized we needed to create a holistic travel experience […] The entire trip” (Airbnb, 2017).

The first direction for expansion was Experiences, which stands at the centre of this investigation. At the same time, Airbnb also explored other expansion opportunities, such as the aviation sector. In 2014, in collaboration with KLM, Airbnb members had the opportunity to win a stay in a grounded airplane that had been converted into an apartment at Schiphol Airport (KLM, 2014). In 2016, Airbnb served as the trading platform for Lufthansa tickets (Farber, 2016; The Economist, 2016). Since then, Airbnb has also partnered with four major airlines – ANA, British Airways, Delta and Qantas – to expand its market reach by offering airline miles and points (Ziggy, 2020).

The introduction of Experiences

Airbnb introduced Experiences in 2016. Airbnb Experiences are activities organised and typically led by a local host. Airbnb (2020a) describes Experiences as, “[…] not your typical tour. Whether you’re on a trip, exploring your own city or staying at home, learn something new from an expert host. Choose from dance lessons, pasta-making or even yoga with goats.”

The selling proposition communicated by Airbnb is that the Experiences offered on its platform are authentic and unique as they offer the opportunity to genuinely immerse oneself in a local community. The fact that Airbnb accommodation is traditionally associated with ‘living like a local’ is helpful in marketing Experiences. Just like its accommodation offerings, these activities and tours are led by locals, further reinforcing Airbnb’s positioning as an alternative tourism service provider. That is, one that opens doors for travellers to experience places and adventures – together with locals – in an authentic way. This positioning differs greatly from the contrived mass tourism – i.e. standardised – offerings often associated with the mainstream tourism industry. Airbnb emphasises that its Experiences are of a high standard and led “by locals who love where they’re from and what they do” and run with “intimate group sizes” (Airbnb, 2020a). When they were first offered, Experiences were mostly focused on the opportunity to try out a hobby with a local host in their home city, such as visiting a local market, cooking regional cuisine at the host’s home, craft and jewellery making, and participating in an adventure activity, such as kite surfing or kayaking. However, as the platform evolved – and in an attempt to differentiate its offerings from traditional providers of tourist attractions – Airbnb increasingly moved toward showcasing Experiences which were highly unusual in the traditional tourism sector, such as playing mermaid in San Diego, chainsaw carving in Salem, extracting your own DNA into a necklace, and learning to eat fire (Airbnb, 2020b). Despite these deliberate positioning efforts, most Experiences offered on Airbnb are not unique and compete with traditional local tourism providers. In response to the COVID-19 pandemic, Airbnb was again agile, transitioning its Experiences online and offering virtual activities and events run by local experts around the world from the comfort of their own homes.

To the best of the authors’ knowledge, Airbnb was a pioneer in the experience market. The concept was quickly adopted by new market entrants, leading to an explosion of peer-to-peer experience platforms offering activities and tours with local hosts. Some examples include: Tours by Locals (toursbylocals.com), Show Me Around (showaround.com) and I Like Local (i-likelocal.com). Of particular note is the expansion of peer-to-peer culinary offerings; for example, the Traveling Spoon (travelingspoon.com) which offers cooking classes with locals, and eating with a local host via Eat With (eatwith.com). As a way of extending these local host offerings, several online platforms (often with supporting smartphone apps) have emerged to enable travellers to connect with each other in destinations to jointly participate in experiences. Examples include Travello (travelloapp.com) and Travel Buddies (travel-buddies.com), in addition to well-established travel brands such as Lonely Planet’s Thorn Tree Forum, a place for people to post their travel plans, connect with each other and travel together.

The evolution of Experiences

To gain an understanding of the early Experiences offered by Airbnb, we analysed the Experiences most likely to compete with tourism activities offered by local providers that were available across the world in July 2017: 41 sport, 59 nature, 64 entertainment and 55 food and drink Experiences (results first reported in Gardiner & Dolnicar, 2018). As can be seen in Table 8.1, surf lessons were the most frequently offered Experiences on Airbnb in 2017, followed by bike tours, stand up paddle board lessons and sailing tours or lessons. Among the offerings in the nature category, hiking, gardening and farming were the most common activities listed. Of the entertainment Experiences, traditional dancing and music were most common, with the food and drink category dominated by culinary experiences and cooking classes, followed by wine and spirit tastings.

| Sport | Nature | ||

|---|---|---|---|

| Surf lesson | 24% | Hiking | 20% |

| Bike ride tour | 15% | Gardening or florist experience | 14% |

| Stand up paddle board lesson | 12% | Farming experience | 10% |

| Sailing tour/lesson | 10% | Photography | 8% |

| Kayaking tour | 5% | Walking tour | 8% |

| Stunt lesson | 5% | Sailing experience | 5% |

| Other | 29% | Horse riding | 3% |

| Kayaking | 3% | ||

| Other | 12% | ||

| Entertainment | Food and drink | ||

| Traditional dancing | 11% | Culinary experience | 33% |

| Music | 11% | Cooking class | 24% |

| Acting and theatre | 9% | Wine tasting/winery tour | 15% |

| Comedy | 9% | Spirit tasting/workshop | 7% |

| Photography | 8% | Coffee tour/workshop | 7% |

| Local food and beverage | 6% | Beer tasting/brewing workshop | 4% |

| Burlesque lesson | 5% | Food markets and shopping | 4% |

| Wrestling lesson | 3% | Other | 6% |

| Sailing and cruising | 3% | ||

| Motorcycle ride | 3% | ||

| Magic workshop | 3% | ||

| Other | 29% |

Airbnb’s Experiences offering has expanded greatly since our initial research in 2017. At the beginning of 2020 – before the impact of COVID-19 on the global tourism industry– over 10,000 Experiences were listed on the Airbnb platform. The number of categories of Experiences on offer had also been expanded from four to six. The two newly introduced Experiences categories were arts and culture and wellness.

Given this expansion, the 2020 follow-up study on Airbnb Experiences focused on three cities located in different continents around the world, which offer a comparable number of Experiences: Edinburgh in Scotland (174 Experiences), Melbourne in Australia (98 Experiences) and Seattle in the United States (Experiences). Only single-day experiences were included. Data was collected between 28 March and 1 April 2020. A total of 422 experiences were analysed. Several experiences were listed under multiple category types. In these cases, the most relevant category was selected. For example, a photo shoot in a food market was coded under arts and culture as the main purpose of the activity was photography, however this activity is also shown as a food and drink experience on the platform.

Table 8.2 presents the profile of Airbnb Experiences in each of the three cities and data regarding these Experiences’ customer evaluations, duration, inclusions, language, price, and maximum group size. To provide further detail on the diversity of experiences, the activities in each city are shown in Table 8.3. These results show the evolution of Airbnb Experiences over the last three years and highlight changes to the profile of Experiences as the platform gained momentum.

| Type | Edinburgh | Melbourne | Seattle | Average across the three cities |

|---|---|---|---|---|

| Arts and culture | 77 (44%)1 | 30 (31%) | 44 (29%) | 50 (36%) |

| Food and drink | 41 (24%) | 28 (29%) | 38 (25%) | 36 (25%) |

| Nature | 20 (11%) | 24 (24%) | 42 (28%) | 29 (20%) |

| Sport | 17 (10%) | 12 (12%) | 12 (8%) | 41 (10%) |

| Entertainment | 19 (11%) | 2 (2%) | 7 (5%) | 14 (7%) |

| Wellness | 0 (0%) | 2 (2%) | 7 (5%) | 3 (2%) |

| Customer evaluations | ||||

| Average customer star rating | 4.84 | 4.95 | 4.92 | 4.90 |

| Largest number of customer reviews for a single activity | 2,649 | 873 | 1,196 | 1,572 |

| Average number of customer reviews2 | 101 | 77 | 84 | 87 |

| Duration1 | ||||

| Maximum (hours) | 12 | 12 | 12 | 12 |

| Minimum (hours) | 1 | 1 | 1 | 1 |

| Average–mode3 (hours) | 3 | 2 | 2 | 2 |

| Average–mean4 (hours) | 3.0 | 4.4 | 3.1 | 3.5 |

| Inclusions | ||||

| Food | 26% | 46% | 43% | 38% |

| Drink | 41% | 58% | 59% | 53% |

| Equipment | 41% | 47% | 51% | 46% |

| Language | ||||

| English | 98% | 96% | 100% | 98% |

| English, local and other non-local language | 9% | 10% | 4% | 8% |

| Price (in Australian dollars) | ||||

| Highest price experience | $417 | $208 | $588 | $404 |

| Lowest price experience | $2 | $5 | $27 | $11 |

| Average price experience–mean3 | $85 | $94 | $142 | $107 |

| Maximum group size2 | ||||

| Largest | 20 | 20 | 85 | 41 |

| Smallest | 2 | 1 | 1 | 1 |

| Average–mode3 | 10 | 8 | 10 | 10 |

| Average–mean4 | 7.7 | 6.9 | 9.4 | 8.0 |

| Edinburgh | Melbourne | Seattle | Average across the three cities | |||||

|---|---|---|---|---|---|---|---|---|

| Activity | Count | Percent | Count | Percent | Count | Percent | Count | Percent |

| Photography | 18 | 10% | 12 | 12% | 13 | 9% | 14 | 10% |

| History walk | 40 | 23% | 1 | 1% | 6 | 4% | 16 | 11% |

| Culture walk | 16 | 9% | 7 | 7% | 3 | 2% | 9 | 6% |

| Guided hike | 6 | 3% | 6 | 6% | 13 | 9% | 8 | 6% |

| Cooking class | 8 | 5% | 4 | 4% | 14 | 9% | 9 | 6% |

| Day trip | 4 | 2% | 10 | 10% | 3 | 2% | 6 | 4% |

| Workshop | 6 | 3% | 4 | 4% | 10 | 7% | 7 | 5% |

| Animal encounters | 4 | 2% | 3 | 3% | 8 | 5% | 5 | 4% |

| Bike ride | 11 | 6% | 2 | 2% | 3 | 2% | 5 | 4% |

| Pub/bar crawl | 4 | 2% | 5 | 5% | 1 | 1% | 3 | 2% |

| Craft class | 3 | 2% | 3 | 3% | 3 | 2% | 3 | 2% |

| Food walk | 2 | 1% | 3 | 3% | 3 | 2% | 3 | 2% |

| Food tasting | 4 | 2% | 3 | 3% | 1 | 1% | 3 | 2% |

| Wine tasting | 0 | 0% | 4 | 4% | 2 | 1% | 2 | 1% |

| Kayaking | 2 | 1% | 3 | 3% | 2 | 1% | 2 | 2% |

| Nature walk | 2 | 1% | 3 | 3% | 2 | 1% | 2 | 2% |

| Beer tasting | 1 | 1% | 2 | 2% | 5 | 3% | 3 | 2% |

| Spirits tasting | 9 | 5% | 1 | 1% | 0 | 0% | 3 | 2% |

| Boat ride | 0 | 0% | 0 | 0% | 9 | 6% | 3 | 2% |

| Coffee tasting | 0 | 0% | 3 | 3% | 2 | 1% | 2 | 1% |

| Meditation | 1 | 1% | 1 | 1% | 4 | 3% | 2 | 1% |

| Tea tasting | 0 | 0% | 2 | 2% | 2 | 1% | 1 | 1% |

| Art class | 1 | 1% | 1 | 1% | 3 | 2% | 2 | 1% |

| Farm visit | 2 | 1% | 0 | 0% | 4 | 3% | 2 | 1% |

| Scenic run | 1 | 1% | 2 | 2% | 0 | 0% | 1 | 1% |

| Art walk | 1 | 1% | 1 | 1% | 2 | 1% | 1 | 1% |

| Yoga class | 1 | 1% | 1 | 1% | 2 | 1% | 1 | 1% |

| Surf lesson | 0 | 0% | 2 | 2% | 0 | 0% | 1 | 0% |

| Baking class | 4 | 2% | 0 | 0% | 1 | 1% | 2 | 1% |

| Personal styling | 0 | 0% | 1 | 1% | 2 | 1% | 1 | 1% |

| Foraging | 0 | 0% | 0 | 0% | 4 | 3% | 1 | 1% |

| Music walk | 4 | 2% | 0 | 0% | 0 | 0% | 1 | 1% |

| Garden visit | 0 | 0% | 1 | 1% | 1 | 1% | 1 | 0% |

| Market visit | 0 | 0% | 1 | 1% | 1 | 1% | 1 | 0% |

| Social gathering | 0 | 0% | 1 | 1% | 1 | 1% | 1 | 0% |

| Studio visit | 0 | 0% | 1 | 1% | 1 | 1% | 1 | 0% |

| Intimate concert | 0 | 0% | 0 | 0% | 3 | 2% | 1 | 1% |

| Dinner party | 2 | 1% | 0 | 0% | 1 | 1% | 1 | 1% |

| Other | 17 | 10% | 4 | 4% | 15 | 10% | 12 | 9% |

The latest analysis reveals the expansion of the arts and culture offering over the past two years on Airbnb Experiences, now with its own unique category on the platform and representing 36% of Experiences across the three cities. Edinburgh was particularly strong in this area, with 44% of its Experiences in this category. This is reflected in the city’s large number of cultural (9%) and historical (23%) walking tours. Across the three cities, history walks (9%) and cultural walks (6%) represented 15% of all Experiences. The other noteworthy development is the offering of photography Experiences, representing 10% of the total offerings analysed. All three cities had a considerable number of photography Experiences.

As similarly found in the 2017 study, guided hikes and cooking classes were a key offering. These types of Experiences represented 6% of all listings across the three cities. Likewise, 5% of Experiences across the three cities were some form of workshop. Jewellery-making workshops featured as a prominent workshop activity. Day trips also featured in this latest analysis (5% of Experiences across the three cities), suggesting that professional tour companies may be leveraging this platform as a distribution channel.

One new type of Experience that has emerged since 2017 is animal encounters (interactions with and caring for animals). These animal Experiences were offered in all three cities and represented 4% of all activities listed. Other activities that featured among Airbnb Experiences across the three cities were locally hosted bike rides, pub/bar crawls, craft classes, food walks, kayaking, nature walks and boat rides. Tasting Experiences related to food, beer, spirits and wine were also prominent. Some new activities that were part of the ‘Other’ category and offered in one city only were: a fitness class, a game night, a motorcycle ride and skateboarding in Edinburgh; a balloon ride, a music lesson, paddle boarding and a wellness class in Melbourne; and a magic show, a fashion class and a museum visit in Seattle. Overall, the analysis shows an increase in the diversity of Experiences offered on the Airbnb platform.

Customer interaction with Airbnb Experiences has also increased in the last three years, with the average number of reviews per activity increasing from 22 in 2017 to 87 in 2020. The highest number of reviews received for a single Experience has also increased, with one Experience receiving 2,649 reviews in the 2020 sample, compared to 363 reviews in 2017. Customers also provided high overall satisfaction ratings for Experiences, resulting in an average rating of 4.90 out of 5 across the three cities.

The inclusion of food in Experiences was comparable across the two data collection periods, however the inclusion of drink decreased – from 84% in 2017 to 53% in 2020 – and the inclusion of equipment increased from 24% in 2017 to 46% in 2020. These differences may be linked to the nature of the Experiences analysed. The local language in the three cities analysed for the 2020 study is English, hence the high level of English-speaking Experiences in these cities. Only a small proportion of Experiences in these cities were offered in a second language (8%).

Analysis of the pricing of Experiences reveals that price-points have also shifted over the last three years, with some very low-priced activities now on offer, beginning at $2 for a walking tour of Edinburgh Old Town and $5 for a guided Chinese tea tasting in Melbourne. The highest priced Experience found in the three cities was playing golf at a famous golf course in Seattle. A motorhome tour of locations for the television series Outlander in Edinburgh and a tour of a famous sport stadium in Melbourne were the most expensive Experiences in these cities. The average price for an Experience in 2020 was $107 across the listings in the three cities, compared to $93 across all listings globally collected in the 2017 sample.

Airbnb Experiences has also evolved to offer greater diversity of group size. It continues to offer single person activities, such as getting your portrait drawn and photography tours, but now also offers more large group Experiences; typically multi-location day-tours. However, the most typical maximum group size in both 2017 and 2020 was the same: ten people. The average group size also remained relatively static at 8.0 in 2020 compared to 7.7 in 2017. Likewise, the average duration of an Experience was nearly unchanged at 3.4 hours in 2017 and 3.5 hours in 2020. Seattle had four outlier Experiences that advertised a duration in excess of 20 hours. These activities included three secret concert events that permitted between 56 and 85 participants as well as a bug-eating adventure that permitted up to 46 participants. This increased the averages for duration and group size for the 2020 results.

Airbnb Experiences during and after COVID-19

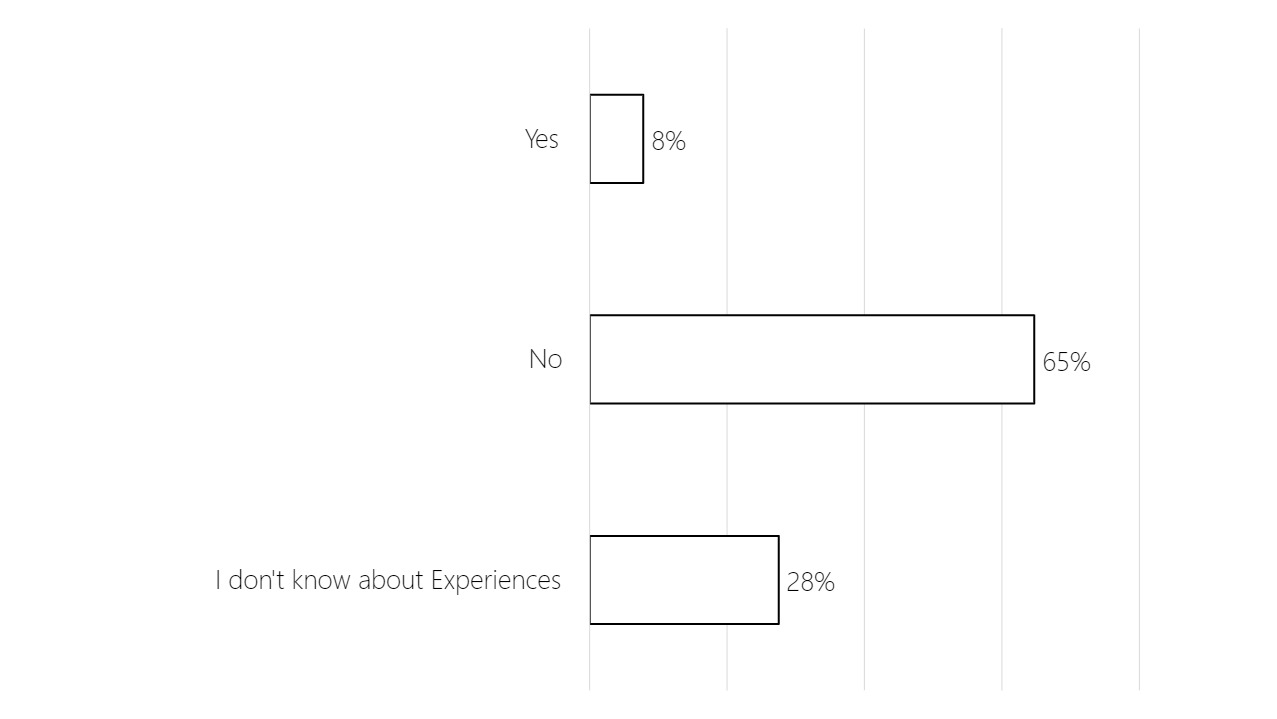

In January 2021 we conducted a survey with Airbnb guests from Australia, New Zealand, the US, the UK, and Canada. Among other things we asked them about Airbnb Experiences. Specifically, we asked the following question: “On Airbnb, you can now also book experiences. Have you ever booked an Airbnb Experience?” Figure 8.1 shows the results. In our sample, only eight percent of Airbnb guests had also booked an Airbnb Experience; 65% had not. Nearly one third of respondents (28%) had never heard of Airbnb Experiences.

Airbnb Experiences were also severely disrupted during COVID-19. The booking of in-person Airbnb Experiences was paused on 18 March 2020. According to the Airbnb (2020c) website, all “reservations that were cancelled because of the Airbnb Experiences pause were automatically refunded in full. Guests also received a $25 coupon to join a future experience”.

As well as pausing in-person Experiences, Airbnb introduced Online Experiences in response to the COVID-19 pandemic. These Online Experiences were themed. For example, the Broadway theme featured on the home page in August 2020 offered dance classes with Broadway entertainers, Broadway workout classes, backstage tours of Broadway, juggling lessons, and storytelling through song.

Bestsellers among these Online Experiences included online cooking classes, magic trick classes, motivational talks, escape rooms, scavenger hunts and quiz games. Consumers could search for activities commencing in the next six hours or scheduled in the next week. New Experiences and current popular Experiences in a customer’s home country were featured separately. Over 300 Online Experiences were listed globally. Although Online Experiences cannot fully substitute personal interactions between tourists and locals, in the context of the COVID-19 pandemic they provide an opportunity to engage with people around the world, the places in which they live and their cultures.

While the pausing of in-person Experiences means a loss of income for both the providers of listed activities and Airbnb, Online Experiences is an innovation that has emerged as a consequence of the movement restrictions intended to limit the spread of COVID-19. The concept of Online Experiences is not revolutionary, but it took a pandemic for Airbnb to come up with the idea and launch it. There is no reason for Online Experiences not to remain part of Airbnb’s offerings long after the pandemic is over.

Conclusions

Pre-COVID-19, demand for space traded on Airbnb had been continuously increasing since its launch. As a consequence, Airbnb was tempted by the opportunities that expansion into other areas of tourism service provision would bring. The first initiative Airbnb launched that was not related to the trading of space was listing activities led by locals for locals or travellers – Experiences. It is likely – although there is no evidence of this – that Airbnb had aspirations to expand beyond spaces and Experiences.

As Airbnb Experiences grew, the provision of a diverse range of tours, activities and events in as many cities as possible around the world was one of its initial strengths and helped establish the global significance and reach of the platform. As our research comparing offerings in 2017 and 2020 attests, the worldwide growth in the number and diversity of Experiences has been prolific. However, this success also has a downside. As Chesky concludes: “We had an overabundance and went in a lot of directions. We weren’t as focused as we should have been. We lost sight of our values and took for granted what made us special.” (Arlidge, 2020).

It appears that COVID-19 has led Airbnb to rethink its aspirations. The pandemic has caused huge revenue losses and unemployment for tourism businesses globally and Airbnb is no exception. Having faced cancellations worth more than $1 billion (Arlidge, 2020) as a consequence of COVID-19, and being forced to terminate the employment contracts of nearly 2,000 Airbnb employees (Arlidge, 2020), Airbnb CEO and founder Brian Chesky concluded that “Airbnb needs to change. We need to go back to basics – to what really made us successful in the first place. I’m not meant to do real estate. I’m not even meant in a larger sense to do travel” (Arlidge, 2020). This rethinking of Airbnb’s core strategy may well imply that in a post-COVID-19 world, Airbnb will no longer pursue aspirations of expanding the trading of services beyond space and Experiences.

Although, overall, the pandemic had disastrous consequences for Airbnb, it did lead to some innovations, notably Online Experiences. Tours and activities have been greatly affected by COVID-19 because they imply a personal, physical interaction between the host and guest, and between guests participating in the same activity at the same time. The newly introduced Online Experiences do not require physical co-location, and are therefore unaffected by movement restrictions. They represent a new income stream for Airbnb and, perhaps more importantly, for some of the many small service providers having found themselves without income during the pandemic. It is likely that Online Experiences will continue to be offered even after movement restrictions are lifted. The ongoing offering of Online Experiences may also represent an avenue for attracting new customers to Airbnb, including customers facing financial or physical barriers which prevent them from engaging in in-person Experiences (Randle & Dolnicar, 2018). Other COVID-19-induced innovations include the introduction of COVID-safe plans for operators. These plans mean that all operators offering a specific activity for a certain number of people must comply with the same requirements, levelling the playing field between peer-to-peer operators and mainstream operators.

Many in-person Experiences offered on peer-to-peer networks such as Airbnb are likely to resume post-COVID-19. They are typically small group Experiences offered by local hosts who are individual operators (microentrepreneurs) with low fixed costs. They are likely to respond in an agile and innovative way by modifying their Experiences to address the post-COVID-19 safety requirements of the tourism industry’s ‘new normal’.

A post-COVID research agenda

When Airbnb first entered the market, research into Airbnb exploded. Every aspect of peer-to-peer accommodation trading was studied in detail. The launch of Airbnb Experiences did not elicit the same response from the scholarly community, nor did it trigger the same outcry in the community of concerns relating to consumer safety. Peer-to-peer accommodation continues to be the focus of research activity.

Research on peer-to-peer accommodation points to the critical importance of the experiential and social aspects of the offering to guests. Makkar and Yap (2020) suggest that guests romanticise Airbnb accommodation and that this blurs the lines between social interaction and commercial motives in exchanges between hosts and guests. Is this also the case for peer-to-peer traded Experiences? What are the roles of fantasy and novelty in Experiences? Authenticity also emerges as one of the unique selling propositions of peer-to-peer accommodation, influencing brand loyalty (e.g., Mody et al., 2019; Shuqair, Pinto & Mattila, 2019). The role of authenticity and brand loyalty in the context of Experiences remains under-investigated.

There has also been significant debate on how peer-to-peer accommodation offerings fit into the tourism ecosystem (Caldicott et al., 2020), yet discussion of the role of peer-to-peer activities and tours is absent. Given the growing number of micro-businesses in this marketplace and the influence these businesses are having on tourism destinations and local livelihoods, conducting research to better understand and sustainably manage this growth is critical. Of particular importance is to understand whether peer-to-peer activities and tours add to a destination’s tourism offering and grow demand for a destination – that is, enhance visitor numbers, length of stay and spend – or if they intensify competition with mainstream activities and tour businesses for market share. Understanding how they interact with marketing organisations and governance structures at the destination is also important. Likewise, understanding the supply-side perspective on developing and delivering these activities and tours is also warranted given the potential employment and livelihood generating opportunities this marketplace represents. How peer-to-peer businesses fit in a destination’s tourism ecosystem and COVID-19 pandemic recovery plan is little understood. Mechanisms for local hosts to get involved in collectively marketing the destination and, importantly, contributing funding and know-how to the campaigns and activities of destination marketing organisations, need to be explored to avoid perceptions (and perhaps the reality) of free-riding and to ensure this emerging sector of the industry is part of a destination’s long-term marketing and management strategy.

And finally, the implications of COVID-19 on activities and tours offered through peer-to-peer networks continue to evolve. We have already seen providers innovate and adapt their activities and tours to provide virtual experiences in the face of the pandemic. Is this change temporary or will it result in a lasting evolution of this marketplace? Will online experiences replace physical travel to a destination or instead increase motivation to visit a place? Will they help tourism operators become more resilient in the face of future pandemics (that may lead to movement restrictions)? What role could online experiences play in maintaining connection to and motivation to visit places during a pandemic? How will peer-to-peer trading networks manage the implementation of COVID safety plans?

Acknowledgements

This chapter is based on Gardiner, S. and Dolnicar, S. (2018) Networks becoming one-stop travel shops, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 87-97.

Survey data collection in 2021 was approved by the University of Queensland Human Ethics Committee (approval number 2020001659).

References

Airbnb (2017) Airbnb & KLM – the airplane apartment, retrieved on October 16, 2017 from https://www.youtube.com/watch?v=efNyRmTLbjQ

Airbnb (2020a) How Airbnb works, retrieved on October 22, 2020 from https://www.airbnb.com.au/d/howairbnbworks

Airbnb (2020b) 10 weird and wonderful experiences you didn’t know existed on Airbnb, retrieved on October 22, 2020 from https://news.airbnb.com/10-weird-wonderful-experiences-you-didnt-know-existed-on-airbnb

Airbnb (2020c) When and where will Airbnb Experiences reopen, retrieved on August 31, 2020 from https://www.airbnb.com.au/help/article/2830/when-and-where-will-airbnb-experiences-reopen

Arlidge, J. (2020) Inn trouble: why Airbnb is going back to basics, retrieved on August 22, 2020 from https://www.theaustralian.com.au/weekend-australian-magazine/inn-trouble-why-airbnb-is-going-back-to-basics/news-story/83366eaa4c9b570d20a5eeffec4ad59c

Caldicott, R.W., von der Heidt, T., Scherrer, P., Muschter, S. and Canosa, A. (2020) Airbnb – exploring triple bottom line impacts on community, International Journal of Culture, Tourism and Hospitality Research, DOI: 10.1108/IJCTHR-07-2019-0134

Farber, M. (2016) This airline is selling seats for its flights on Airbnb, retrieved on July 27, 2017 from http://fortune.com/2016/07/26/airline-flights-airbnb

Gardiner, S. and Dolnicar, S. (2018) Networks becoming one-stop travel shops, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 87-97, DOI: 10.23912/9781911396512-3606

KLM Royal Dutch Airlines (2014) Airbnb & KLM – The airplane apartment, retrieved on July 27, 2017 from https://www.youtube.com/watch?v=ojdfIaYAMKg

Makkar, M. and Yap, S.F. (2020) Managing hearts and minds: romanticizing Airbnb experiences, Current Issues in Tourism, DOI: 10.1080/13683500.2020.1792855

Mody, M., Hanks, L. and Dogru, T. (2019) Parallel pathways to brand loyalty: Mapping the consequences of authentic consumption experiences for hotels and Airbnb, Tourism Management, 74, 65-80.

Randle, M. and Dolnicar, S. (2018) Guests with disabilities, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 244-254, DOI: 10.23912/9781911396512-36120

Reinhold, S. and Dolnicar, S. (2018) Airbnb’s business model, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 27-38, DOI: 10.23912/9781911396512-3601

Reinhold, S. and Dolnicar, S. (2021) The evolution of Airbnb’s business model, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Roy Morgan Research (2017) Airbnb customers most likely to return for more, retrieved on August 29, 2017 from http://www.roymorgan.com/findings/7057-airbnb-customers-most-likely-to-return-for-more–201611210854

Roy Morgan Research (2018) Melbourne way ahead of Sydney as ‘Airbnb hub’, retrieved on August 26, 2020 from https://www.roymorgan.com/findings/7576-melbourne-way-ahead-of-sydney-as-airbnb-hub-march-2018-201805020938

Shuqair, S., Pinto, D.C. and Mattila, A.S. (2019) Benefits of authenticity: Post-failure loyalty in the sharing economy, Annals of Tourism Research, 78, 102741, DOI: 10.1016/j.annals.2019.06.008

The Economist (2016) Lufthansa offers a seat on Airbnb, retrieved on July 27, 2017 from https://www.economist.com/blogs/gulliver/2016/07/compact-and-bijou

Ziggy (2020) How to earn airline miles & points through Airbnb, retrieved on August 26, 2020 from https://travelingformiles.com/how-to-earn-airline-miles-points-through-airbnb