5 Hosting and co-hosting on Airbnb – before, during and after COVID-19

Sheranne Fairley, Department of Tourism, UQ Business School, The University of Queensland, Australia

Kathy Babiak, School of Kinesiology, University of Michigan, USA

Sarah MacInnes, Department of Tourism, UQ Business School, The University of Queensland, Australia

Sara Dolnicar, Department of Tourism, UQ Business School, The University of Queensland, Australia

Please cite as: Fairley, S., Babiak, K., MacInnes, S. and Dolnicar, S. (2021) Hosting and co-hosting on Airbnb – before, during and after COVID-19, in S. Dolnicar (Ed.) Airbnb before, during and after COVID-19, University of Queensland DOI: https://doi.org/10.6084/m9.figshare.14204531

Hosting on Airbnb before COVID-19

When Airbnb was first founded, it was perceived as an alternative avenue of securing accommodation when travelling. The initial assessment by the licensed commercial tourism accommodation sector was that Airbnb would not stand in direct competition with it (von Briel & Dolnicar, 2021). The pioneers among the hosts were befrienders who enjoyed getting to meet travellers during their journeys, and ethicists who were true believers in putting their underutilised spaces to good use (Hardy & Dolnicar, 2018a; Karlsson & Dolnicar, 2016). As word spread about the benefits of peer-to-peer accommodation, it developed from a fringe phenomenon to a mainstream tourist accommodation option. As such, it attracted more and more capitalist hosts (Hardy & Dolnicar, 2018a; Karlsson & Dolnicar, 2016) – people who entered the short-term rental market for the sole purpose of maximising their return on investment. This shift caused dismay among the pioneers of hosting who felt that the original ethos of Airbnb had disappeared (Hardy & Dolnicar, 2018b) and that Airbnb.com had become just another commercial distribution channel for tourist accommodation.

Befriender, ethicist and capitalist hosts experienced hosting differently because of the substantial differences in their personal business models. Many befrienders and ethicists were renting out spare rooms – spaces that were part of their primary residence and were sitting idle. Listing those spaces on Airbnb came at minimal additional cost to them – they had to wash towels and bedlinen and used a marginal additional amount of electricity and water. If nobody booked those spaces, befrienders and ethicist hosts had no additional expenses at all. As a consequence, they had the freedom to list and delist spaces at their leisure, independent of whether their spare spaces were required for a different purpose or not (Dolnicar, 2018). From Airbnb’s perspective, these were probably the most attractive hosts in terms of being most resilient to any external circumstances, as COVID-19 would later show.

Capitalists were in a different position altogether. They were pro-actively leveraging the entrepreneurial opportunities offered by Airbnb (Sigala & Dolnicar, 2018). Some entered long-term rental agreements with owners to use the property for their short-term rental businesses. Others purchased properties under the assumption that the income from short-term rentals would repay their mortgage.

Over the years, Airbnb moved away from its roots. The proportion of capitalist hosts continuously increased. For example, the proportion of hosts listing more than one property was 42% in 2016, growing to 49% in 2020 (Ferreri & Sanyal, 2018; Inside Airbnb, 2020). With the increase of capitalist hosts, another entrepreneurial opportunity developed: offering full-service hosting to those capitalist hosts, an opportunity Airbnb encouraged via its co-hosting scheme.

To better understand how Airbnb hosts view their roles as accommodation providers, we conducted a small self-report survey in January 2021, comprising 40 Airbnb hosts from Canada, the US, the UK, New Zealand and Australia. We asked respondents to reflect on their time as an Airbnb host, and whether they felt that providing accommodation on Airbnb was more personal than providing accommodation any other way (43%) or just like providing accommodation any other way (58%).

Despite this shift towards seeing Airbnb as similar to any other provision of accommodation, when asked if hosts felt like they were sharing with the guest, 68% responded ‘yes’. Those who felt they were sharing with their guests reported sentiments such as “Yes you are sharing your own personal space and belongings, way of life, local community etc.” and “…I feel this way because I feel like I am sharing a certain aspect of my life with the guest by sharing my space with him or her”. Of those who did not feel they were sharing with the guest, respondents reported feelings such as “No it is purely a business transaction for me. I feel no personal attachment” and “I don’t feel I’m sharing with them because they are my clients”.

In response to being asked if hosts felt they were collaborating with guests, 45% responded ‘yes’. For those who felt they were collaborating, explanations such as “I feel as if I am collaborating with the guest because we actually have to come to an agreement and then I have to make sure the guest has a great stay” and “It is indeed very necessary to have a nice collaboration with your guests. It provides us a sense of achievement” were given. Those who did not feel they were collaborating largely reported perceiving hosting purely as a business transaction; “No, as above it is purely a financial decision” and “No, mostly I have never interacted with the guests face to face and hence I do not feel as if I am collaborating with the guest”.

Lastly, hosts were asked whether they felt they were selling a service to their guests, to which 83% responded ‘yes’. These hosts reported feelings such as “I have to compete with other hosts on Airbnb, so I would have to “sell” my service to them in a way that makes them prefer me” and “Yes, because they are using my property in exchange for money”. Of the few who did not feel they were selling a service, these hosts reported feelings such as “No because I feel that I am lending my place mainly…” Ultimately, these stark contrasts in host sentiments about their role as accommodation providers illustrate the clear distinctions between different types of hosts.

While hosts showed variation in their opinions of their role as accommodation providers, there was a strong theme to responses regarding motivation for hosting on Airbnb. Hosts were asked to allocate 100 points across the following three categories to indicate which benefit or mix of benefits best describe their motivations for hosting: the ability to make money, to meet travellers and socialise, and to share their unused space. Money was largely seen as the most important benefit, with 11% giving this factor alone the full 100 points. Meeting travellers and socialising, and sharing unused space were evidently unimportant to many, with 26% and 25% of respondents allocating these categories 0 points respectively.

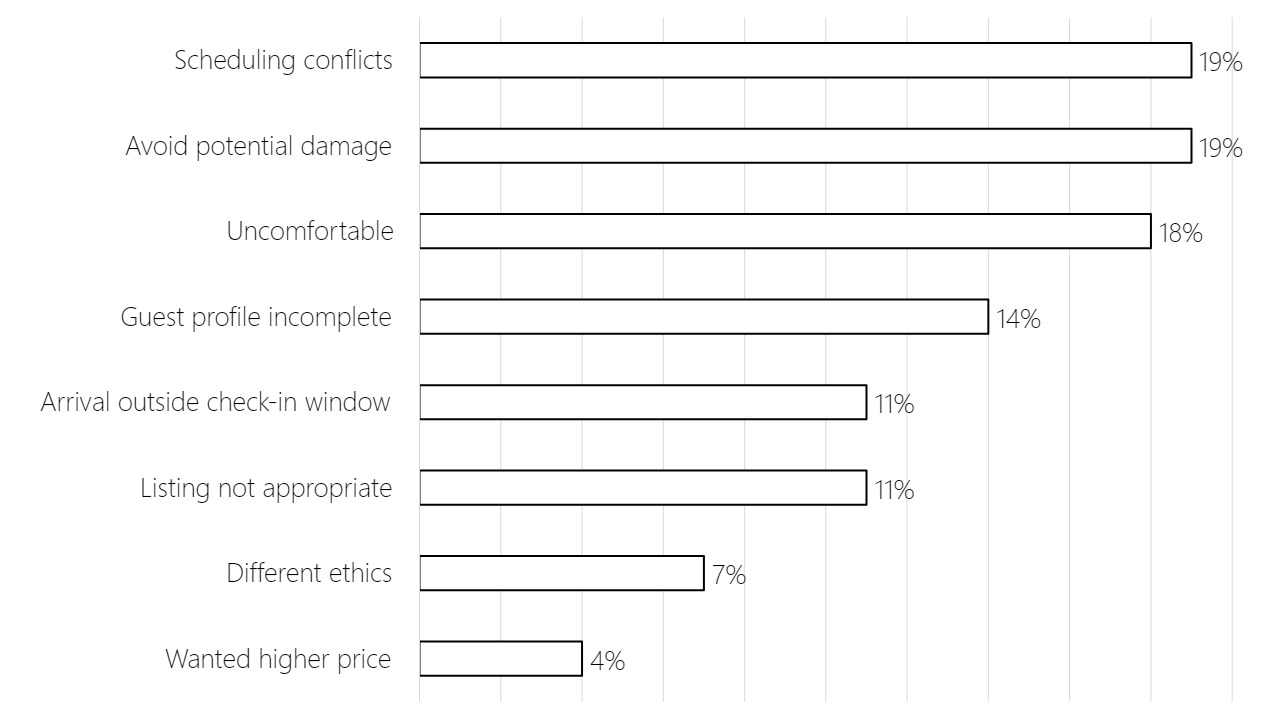

One key distinction between Airbnb and traditional accommodation providers is the ability of hosts to review the details of individual booking requests from guests, and to decline requests if desired. Of the Airbnb hosts surveyed, only 12% reported the ability to decline a request as ‘not important’. The remaining 56% regarded it as ‘important’ and 12% as ‘very important’. Almost half of the hosts (46%) reported declining a booking request at some point. Reasons given for declining a booking request were varied (see Figure 5.1). Ultimately, the reasons given illustrate the contrast between traditional accommodation provision and Airbnb hosts. Reasons such as ‘the guests did not seem to have the same ethics as me’ and ‘I was uncomfortable with the booking’ would not be appropriate reasons for hotels to decline a guest booking.

To gain further insight into the different values of hosts and how these relate to their perception of guest bookings, hosts were asked to rank features of guest booking requests in order of importance (pre-COVID-19). There was a broad spread of rankings in the responses, further confirming the variability of Airbnb hosts and their values. The features ‘review scores given from other hosts’ and ‘number of people’ in the booking were largely rated as the most important, each ranked first in importance by 30% of respondents. ‘Number of prior reviews by hosts’ was thought to be moderately important, ranked second by 23% of respondents and fourth by 23% of respondents. ‘Content of reviews from other hosts’ was largely rated third (32%), while ‘language spoken’ and ‘country of origin’ were thought to be least important, with 39% ranking ‘language spoken’ sixth and 40% ‘ranking country of origin’ seventh.

Despite variability in the hosts’ views of their role, their ability to decline booking requests, and the importance of different features of booking requests, when asked about their feelings for Airbnb, hosts were overwhelmingly positive; 77% reported that they loved Airbnb, 13% indicated they were neutral and 0% reported that they hated Airbnb.

Co-hosting on Airbnb before COVID-19

Peer-to-peer accommodation networks have created a wide variety of entrepreneurship opportunities (Sigala & Dolnicar, 2018). Initial analyses of these entrepreneurship opportunities focused on the hosts themselves, as well as on providers of essential services to hosts. At the very minimum, essential services include cleaning and laundry management, but may also include garden and pool maintenance. As peer-to-peer accommodation networks grew, and renting holiday accommodation from a private person – as opposed to a professional, licensed, commercial provider – became normal among tourists, an increasing number of capitalist hosts entered the market. Such hosts had no interest in managing the daily operations of their short-term rental business. They focused on renting or purchasing suitable properties and maximising their return on investment, and sought to outsource all hosting-related activities in their entirety (Fogacs & Dolnicar, 2018). Outsourcing represented a more efficient way for capitalist hosts to run their businesses. Outsourcing also promised increased guest satisfaction and better reviews at a time when tourists no longer viewed Airbnb-listed accommodation options as a niche offering for alternative travellers; they had raised their expectations and were starting to benchmark Airbnb-booked properties directly against hotel rooms (Mohlmann, 2015). Demand grew for full-service co-hosting providers (Sigala & Dolnicar, 2018); people or businesses who would effectively take on the entire hosting role. In response to this market need, a substantial number of full-service co-hosting services were established. In some instances by individual micro-entrepreneurs, in others by start-up companies or existing businesses already catering to tourism accommodation providers.

Entrepreneurship scholars have long sought to identify the complex factors that influence new business venture creation (Phan, 2004). Research has tended to follow three main themes: the outcomes of entrepreneurship, the drivers and causes of entrepreneurship, and the management of new entrepreneurial ventures (Stevenson & Jarillo, 1991). While Sigala (2018) identified entrepreneurs within the Airbnb ecosystem and analysed the services they offer, we know little about how, where, when, and why these new ventures emerge. To gain insights into these aspects, we conducted a detailed interview with a full-service provider micro-entrepreneur who built a co-hosting business. We report insights in the following sections.

Emergence of the new venture

Entrepreneurs exploit opportunities and assets in their environments to create sustainable advantage (Perks & Struwig, 2005). To compete effectively, micro-entrepreneurs need to consider the financial, strategic, structural, and organisational conditions that affect their businesses – aspects directly influenced by access to information and industry-specific knowledge. Peer-to-peer accommodation networks have characteristics that can be advantageous for micro-entrepreneurs, such as low barriers to entry (Forgacs & Dolnicar 2018). In addition, they may provide opportunities for low-skilled workers, hospitality graduates, or individuals whose life circumstances are not conducive to structured employment, as in the case of the micro-entrepreneur we interviewed, whose co-hosting business idea emerged when his health forced him to take time off from regular employment:

“I took a year off work… for health reasons and… [my neighbour] was really into Airbnb. She said, “Hey, you’d be really good at this”…. I never thought upfront, “Hey, this is what I want to do as a business.” It just happened… and then it has evolved.”

His background in hospitality was an asset:

“I’ve got a 10-year background in high-end hospitality… organising people and getting projects, communication and emails. So that background fits into doing this [business] because it’s really about hospitality, making sure everything is perfect.”

The co-hosting business grew through referrals as well as through a feature on the Airbnb website that helped match hosts and co-hosts (Janna, 2017). This feature is no longer available, possibly because of Airbnb’s ambitions to expand its services in this area. Airbnb acquired Luckey Homes in 2018 (Stevens, 2018), an established full-service co-hosting service provider (Airbnb, 2020a). The entrepreneur we interviewed leveraged knowledge of Airbnb’s co-host community to grow his business, with advertising channels evolving with the growth:

“I advertised myself as a co-host so people could go onto Airbnb [website] and would come up with a theme saying, “No time to host your property or you’re running short on time, search for a co-host.” Then I would search in a… 10 km radius around where I live, and if they fell into the same bucket, then I would get their request looking for a co-host… I’ve now launched my website, Facebook, Google advertising.”

For micro-entrepreneurs in peer-to-peer networks, building an image of trust and developing a reputation are essential. Our entrepreneur stated:

“Reviews are important; it’s what people look at. They look at the photos, they look at the location, the price. Photos are number one, and then reviews.”

Given the importance of reviews, business processes are set up to generate more reviews. Trust reduces risk and is central to entrepreneurship (Welter, 2012). Establishing trust through the Airbnb review platform is therefore key to growing the business:

“I do one-night minimum stays, not two-night minimum stays because I want turnover. I want reviews… I’m directing people to look at my Airbnb profile and read the reviews. I don’t want to have it all come from my mouth. I want [people to know] what my guests are saying.”

Full-service co-hosts manage the whole enterprise. In this model, Airbnb hosts outsource services to an external agency that retains a percentage of the rental income. The micro-entrepreneur develops contracts and payment schedules, prepares the space for rental (e.g. buys furniture and bedlinen, provides advice on how to position and manage a property, markets the property), performs property maintenance, and troubleshoots for guests. Skills and capabilities identified as necessary for business growth include self-development skills, networking skills, relationship marketing, time management, negotiation, and general business skills (e.g. technology, record keeping) (Perks & Struwig, 2005).

Airbnb saw the benefits of encouraging co-hosting some time ago. In 2016, Airbnb introduced its co-hosting function on Airbnb.com, enabling someone other than the owner or long-term tenant of the listed property to take over all hosting work on their behalf (Kokalitcheva, 2016). Co-hosting had the potential to boost the further growth of Airbnb, as it facilitated the entrance of capitalist hosts with neither the time nor interest in personally engaging in hosting. Airbnb defines co-hosting as follows: “Co-hosts help listing owners take care of their home and guests. A co-host is someone the listing owner already knows. They are usually a family member, neighbour, trusted friend, or someone the host has hired to help with the listing. Hosts and co-hosts agree on who’s responsible for what, how much of the reservation income will go to the co-host, and how the co-host will be reimbursed for expenses” (Airbnb, 2020b).

Both hosts and co-hosts offer employment to other service providers, most commonly cleaners, who are engaged on a casual basis. In contrast to managers in many traditional organisations, managers in the gig economy oversee individuals who are not technically on staff (Forgacs & Dolnicar, 2018):

“When I need cleaners there’s no shortage. I’ll put an ad on Facebook… It doesn’t matter if they’ve had a huge amount of cleaning experience… They have to have a car, and a [work permit]. I don’t pay them holiday pay or sick leave… they invoice me every week for the jobs that they’ve done. So they’re independent contractors essentially that work for me directly.”

Communication with guests is a major part of the co-hosting role. Communication in peer-to-peer accommodation is not limited to the booking process. Rather it can start with a booking enquiry and continue until well after the time of the short-term rental taking place, especially in case of a complaint. Typically, however, communication before check-in is the most labour intensive for the co-hosts, as the following description by the entrepreneur we interviewed illustrates:

“Messaging… goes on between myself and the guest from the initial booking to three days before they arrive. They get the check-in instructions, I do a welcome pack… [including] everything from local cafes, bars, restaurants, walking maps, and [transportation cards]. [Upon checkout, guests] get a message saying, “Thanks for staying. Please leave me a review”.”

Technology enables flexibility for both host and guest, as well as coordination with other service providers. Parts of the experience are digitised – communicating with hosts and guests, providing information on the accommodation procedures, and managing ancillary services. Digitisation serves as a trading platform for both peer-to-peer networks and service providers (Wong, 2012). Our entrepreneur used his localised knowledge to offer personalisation to the local community with geographic granularity and customisation for both hosts and guests. New technological platforms allow entrepreneurs to provide efficient service to clientele while having more time to focus on acquiring new business and other essential management activities:

“I was doing the messaging myself. Then I started using an automated service that sends customised templated messages to guests… The automation part has been a life changer... For me it’s about getting out there and meeting new clients and keeping the same level of standard.”

Competition is a central force in strategic positioning (Hussain & Yaqub, 2010). The services provided by micro-entrepreneurs and the way they manage properties differ from competitors such as hotels and other property management companies:

“I don’t want it to be a hotel… So I specifically change my linen so that it’s not white. I put in colour by doing covers and matching pillow slips to make my brand different than a hotel.”

Other Airbnb full-service co-hosting services use hotel-quality linen as a point of distinction, but this practice incurs higher costs for cleaning which get passed along to the guest. Another distinct difference between typical commercial co-hosting services and the micro-entrepreneur we interviewed is that he does not force hosts to enter a long-term contract. This offers another key point of distinction, potentially giving micro-entrepreneurs a competitive advantage:

“There’s no commitment [in my contract], which is another thing the other management companies want, 12 months contracts.”

To make sure the business stays favourably differentiated from competitors, micro-entrepreneur co-hosts have to maintain knowledge of the landscape and new entrants to the market:

“Any new players that I see come on the scene… I get their full prices so that I can compare, to keep in touch with what others are doing. I know that my service is way above what others provide and I provide it at a more affordable cost.”

Micro-entrepreneur co-hosts also consider how they can replicate their models and grow their businesses:

“Now I’ve expanded [to] website, Facebook, promotions, advertising… I want to build it slowly so that it continues to maintain the same standard, and then just replicate that formula that I started with.” As the business grows, the entrepreneur must delegate responsibility to others, and this relinquishing of control can be stressful: “Managing stuff, relying on others to do exactly what the formula is… can be stressful.”

The main challenges micro-entrepreneur co-hosts report are environmental uncertainty and access to financial capital to scale their businesses (Hussain & Yaqub, 2010). The co-host micro-entrepreneur we interviewed is trying to build his systems to ensure the business can be easily scaled.

Interestingly – while Forgacs and Dolnicar (2018) suggest that entrepreneurial ventures provide flexibility and freedom – our example suggests otherwise. Our co-hosting micro-entrepreneur compared his job to conventional property management:

“This is not a job, this is a life. It’s constant, it doesn’t turn off. Taking time off is next to impossible. I work 100% of the time. Even if I go away it’s constant messaging. Property managers work 9:00 to 5:00. They turn off. They’ll manage the next day or whenever they get around to it. I don’t turn off. What I do is really hospitality. There’s no way that anyone can step away from managing Airbnb unless they give it to someone else.”

However, he saw this life as a short-term sacrifice for a long-term goal:

“I don’t want to ever go back to sitting in a 9:00 to 5:00 office job.”

Hosting and co-hosting on Airbnb during COVID-19

COVID-19 caused unprecedented disruption to the global tourism industry. Airbnb was significantly affected. From January to September 2020, Airbnb made USD $2.5 billion in revenue, resulting in a loss of USD $696.9 million. Revenue dropped by 32% compared to the first nine months of 2019 (Sonnemaker & Rapier, 2020). As a result, Airbnb had to let go of a quarter of its workforce and raise emergency funding of around USD $2 billion. Revenue has increased slightly in the third quarter, but – given the second and third waves of the COVID-19 pandemic experienced in many countries around the world – Airbnb predicts even more substantial losses for the end of 2020 compared to the last few months of 2019 (Sonnemaker & Rapier, 2020).

Interestingly, most reporting in relation to Airbnb in the context of COVID-19 focuses on the demand side; the drop in bookings. Airbnb hosts – the supply side – are rarely discussed. Yet, Airbnb cannot operate its business without them. In the early days of the pandemic, Airbnb hosts and co-hosts – spoiled by high returns and the prospect of the ever-increasing growth of the Airbnb market – watched in disbelief as their bookings were cancelled, one after the other. One host reports:

“It’s meant that hundreds of bookings were being cancelled. I haven’t even calculated the number of them at the moment, but for example we had a full week of arrivals this week, and now tomorrow there’s no one coming.” (cited in: Ham, 2020)

Quickly, hosts and co-hosts developed creative ways to continue operating, including setting up their properties to cater to the self-isolation market (Ham, 2020). As the pandemic continued, it became clear to many hosts and co-hosts – especially capitalist hosts who viewed their properties as an investment – that they were unable to continue paying all their expenses without earning any income. In 2020, IPX 1031 surveyed US-based Airbnb hosts (results reported in Lane, 2020), concluding that: hosts expected a 44% drop in revenue between June and August 2020, despite having dropped their prices, on average, by up to $90 a night. Of the surveyed hosts, 47% had safety concerns about renting out their properties, and 45% stated that they would not be able to pay expenses if COVID-19 restrictions last until the end of 2020. At the time of the survey, 16% of the surveyed hosts reported having arranged for a delay in mortgage payments with their bank or having missed a payment. As a result of the devastating impact COVID-19 has had on hosting activities, 41% of the surveyed hosts had to take up another job, and 47% modified their offering to cater to the changed market demand for accommodation. One third of the US-based Airbnb hosts surveyed in the IPX 1031 study participated in Airbnb’s space donation initiative (Hajibaba & Dolnicar, 2018; Zare & Dolnicar, 2021) by making space available to medical staff for free or at a reduced price (IPX 1031, cited in Lane, 2020).

The financial pressure for many Airbnb hosts and co-hosts was so great that they chose to (temporarily) exit the short-term rental market or move from the short-term to the long-term rental market (Lane, 2020; Dolnicar & Zare, 2020; Knezevic Cvelbar, Vavpotic & Dolnicar, 2021).

We surveyed Airbnb hosts in Canada, the UK, the US, New Zealand and Australia in January 2021, at a time when vaccines were being rolled out globally but most nations around the world were struggling to contain second and third waves of the pandemic, aggravated by faster-spreading mutations of the virus.

At the time of this survey, 35% of hosts reported they were experiencing trouble paying their bills, including mortgage repayments. Due to COVID-19, 51% of hosts indicated they were reducing their number of listings, with 9% increasing listings and 40% making no change to their number of listings. In terms of bookings, a vast majority (88%) of hosts reported that their bookings had decreased due to COVID-19, while a minority of 5% found their bookings had increased, 2% did not notice a change and 7% found it was different for different properties. For spaces no longer listed, 59% of hosts reported no longer renting these spaces out until the situation is stable again, while 21% report moving to the long-term rental market temporarily, 14% moving to the rental market indefinitely and 7% even selling their properties.

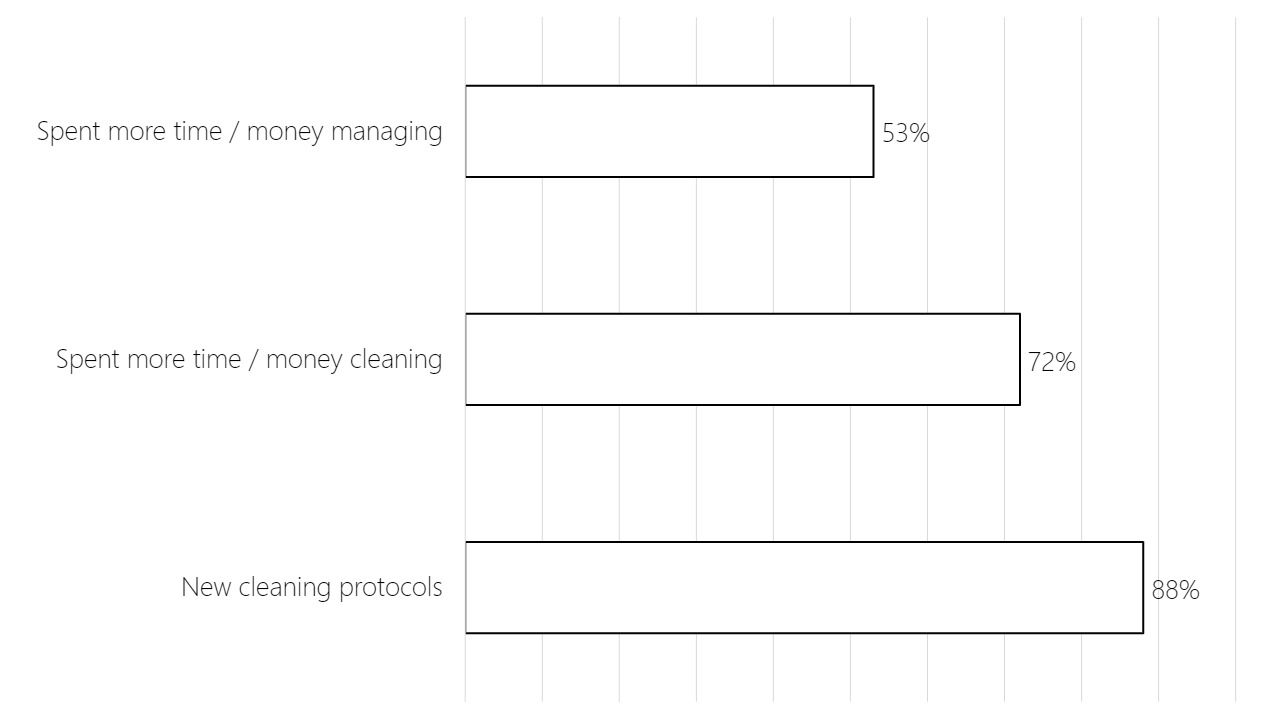

When considering the impact of COVID-19, hosts were asked to what degree they noticed a change to their cleaning protocols and time/money spent managing and cleaning the property (see Figure 5.2). Hosts widely reported changes to their cleaning protocols, which in turn likely led to the stark increase in time/money spent cleaning. Over half of the hosts surveyed reported spending more time/money on managing their properties.

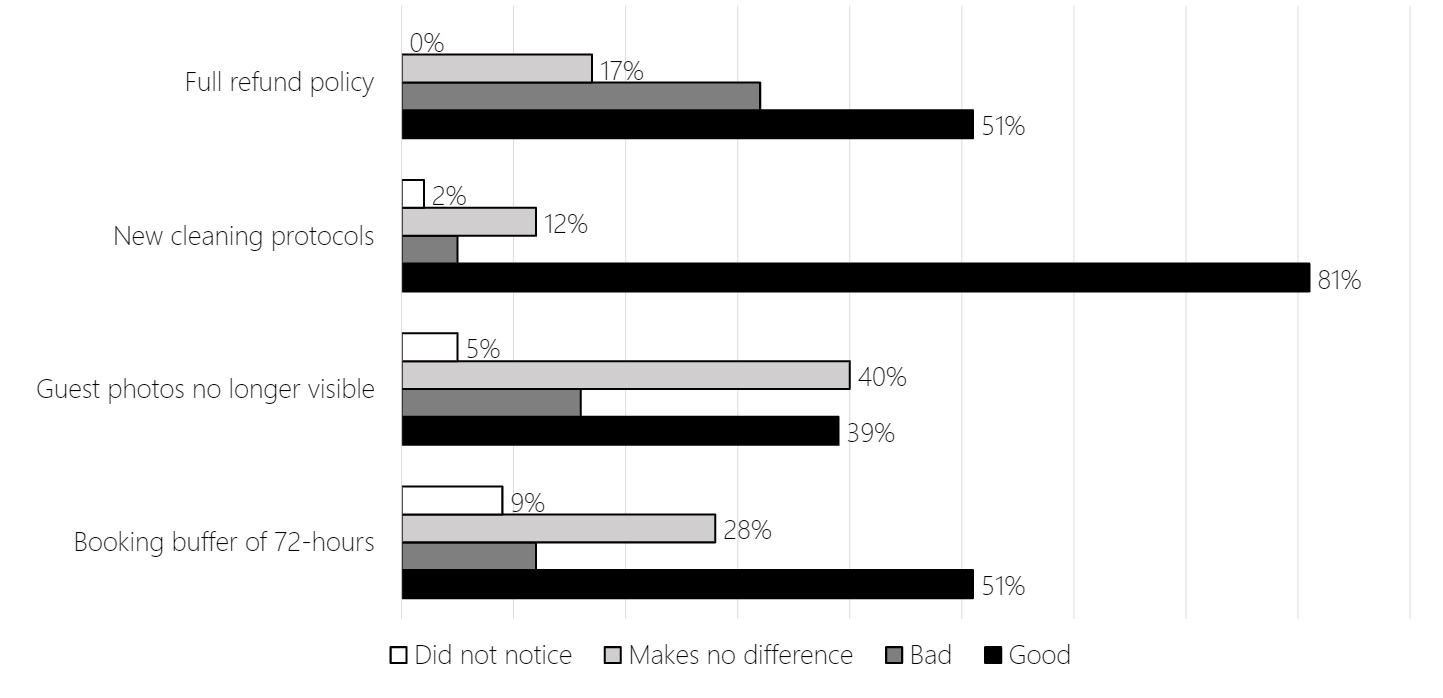

Hosts were asked their opinion on the recent platform changes to Airbnb (see Figure 5.3). Overwhelmingly, hosts seemed to tolerate changes to cleaning, guest photos and the introduced booking buffer. However, given the financial pressure COVID-19 has placed on their income through Airbnb, hosts reported feeling that the full refund policy associated with COVID-19 was a negative change.

Hosts were asked if they had declined more booking requests since the onset of COVID-19, to which 42% responded that they had. Following this, hosts were asked if their reasons for declining bookings had changed since COVID-19, to which 18% also responded ‘yes’. Hosts were asked to re-rank the importance of features when assessing booking requests. The main finding of this was that country of origin, which pre-COVID-19 was ranked as least important by 40% of people, now became the number one most important feature to 40% of hosts.

Ultimately, despite the ingenuity and resilience of many hosts, COVID-19 has had a huge impact on their ability to keep their properties and finances afloat. While the hosting experience has evolved to include the provision of accommodation to medical professionals and people in self-isolation, the overwhelming financial pressure associated with the pandemic has left many hosts struggling to pay their bills and therefore leaving peer-to-peer accommodation either temporarily or indefinitely.

Hosting and co-hosting on Airbnb after COVID-19

Interestingly, despite the effects of COVID-19-related restrictions on the trading of space, hosts generally remain positive about the future, expecting business to return quickly once COVID-19 is under control (Knezevic Cvelbar, Vavpotic & Dolnicar, 2021). In the middle of 2020, more than a third of the surveyed US-based hosts (37%) were expecting bookings to return in the US fall (Lane, 2020). Some hosts are even optimistic for a better future as a result of COVID-19. Hosts have expressed hopes of a return to a more ‘hyperlocal’ mode of travel, with an increase in bookings for rural hosts as guests seek out less populated areas to travel (Halpern, 2020). However, while some hosts may remain optimistic, a recent content analysis revealed widespread anxiety among peer-to-peer accommodation hosts – including Airbnb hosts specifically – related to the effects of COVID-19 and the unpredictable nature of the future (Hossain, 2021).

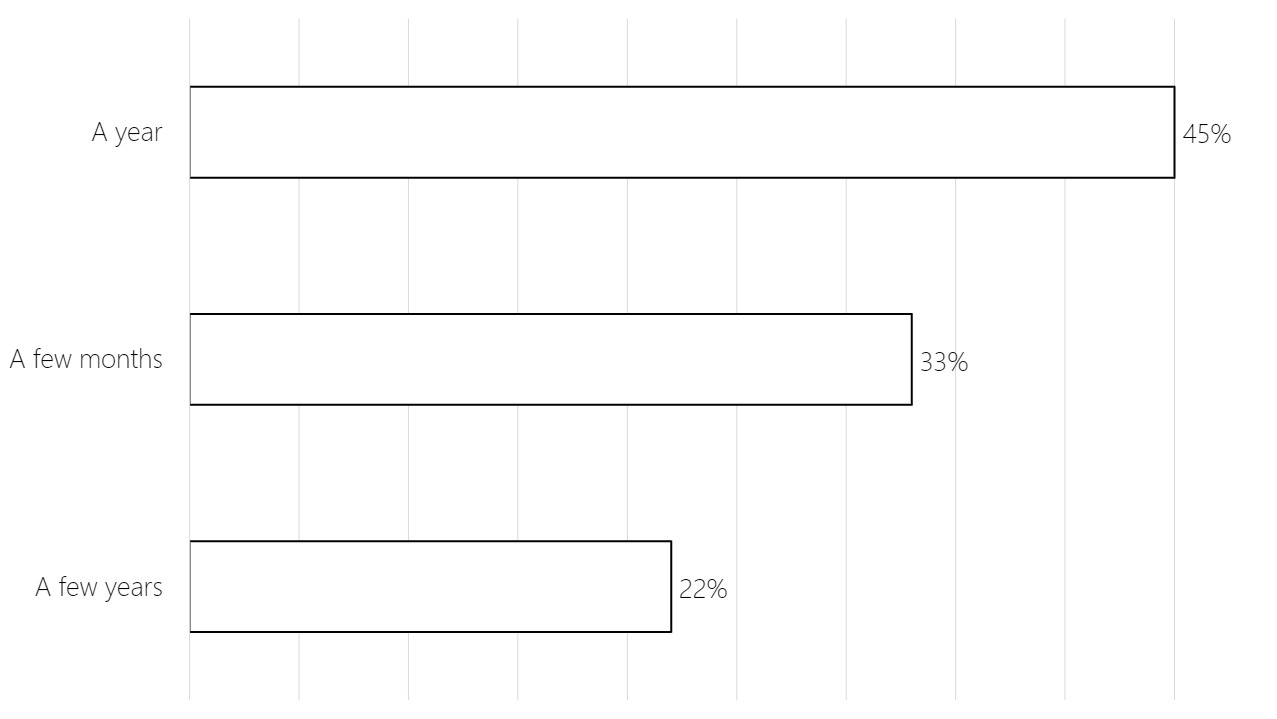

To gain insights into how Airbnb hosts assess the future of Airbnb after COVID-19, we included a number of questions in our 2021 host survey which asked explicitly about host predictions for Airbnb. Specifically, we asked hosts whether they expect their income from peer-to-peer accommodation hosting to recover. Most hosts (74%) expect their income to recover; 16% do not. We asked those who expect their income to recover to estimate the timeframe in which they expect this to happen. Figure 5.3 shows the results: one third of the hosts participating in our survey study expect their income to bounce back within a few months, 45% expect it to take one year and 22% believe that recovery will take longer, expecting their income to return to pre-COVID-19 level in a few years.

Co-hosts share a similar view. One co-hosting business offered the following assessment of the situation:

“It’s been an undeniably rocky road but, 2021 has brought hope that the worldwide vaccination rollout will reopen air corridors and with better testing + hygiene protocols, travel will recommence. Travel, of course, won’t be the same as it once was, but maybe that won’t be a bad thing. Cities will be quieter, tourist overcrowding in places such as Bali or Venice will be less desirable, and the skies are cleaner… It’s too early for long-term predictions, but when the first travellers return to the skies, they will find measures that have become commonplace adapted to flying: mandatory masks, reduced personal contact, enhanced sanitisation, temperature checks, and social distancing.”

Ultimately, it appears that – while the pandemic has been incredibly taxing on hosts, both financially and in causing anxiety for the future – hosts remain largely optimistic about their future with Airbnb.

Conclusions

Airbnb’s beginning is one grounded in ingenuity, triggering a disruption of what came to be considered ‘the new normal’ in accommodation provision. Before the pandemic, hosts continued this theme of creativity, with capitalist hosts entering the market and the inception of entrepreneurial pursuits such as co-hosting. However, Airbnb experienced its own disruption with the emergence of COVID-19, its own ‘normal’ being thrown out the window. Airbnb hosts and co-hosts, with arguably the most to lose, faced severe challenges. Many hosts and co-hosts stayed true to the beginnings of Airbnb and found new ways to provide peer-to-peer accommodation during the pandemic. Despite these efforts, some hosts have reported significant financial pressure and anxiety about what the future holds for them in a post-COVID-19 world. Overall, however, while the future of Airbnb hosts remains uncertain, hosts and co-hosts generally report optimism for the eventual recovery of their finances, the majority predicting recovery as soon as within a year.

The co-host entrepreneur we interviewed before COVID-19 gave reason for optimism:

“My company was strengthened by the disruption of Covid-19. Following mass cancellations in March 2020, we experienced mass bookings for guests for all types of reasons (a common one, was they were stuck & needed long term, immediate accommodation with all utilities included). The result was longer term stays with our average length of stay doubling, from 3 nights to 6. As occupancy was high, demand was also high… so prices were pushed up to 200% of previous year/s. During the longer stays, it gave us time to regroup, re-examine processes, procedures & make positive changes. We are now a bigger, stronger company with streamlined processes to enable us to continue to expand, from a position of strength.”

When asked what the future held for them, they replied:

“COVID made our company stronger. We experienced steady growth of new properties throughout 2020. 2021 will continue to see further growth, higher occupancy, longer length of stay + higher prices than ever before. Once international travel begins to reopen, I envisage that Australia’s tourism market will go through an unprecedented boom!”

Acknowledgements

Survey data collection in 2021 was approved by the University of Queensland Human Ethics Committee (approval number 2020001659).

References

Airbnb (2020a) Hosting handled for you, retrieved on August 19, 2020 from https://www.airbnb.com.au/d/hosting-services

Airbnb (2020b) What’s a co-host? Retrieved on January 22, 2021 from https://www.airbnb.com.au/help/article/1243/whats-a-cohost

Dolnicar, S. (2018) Unique features of peer-to-peer accommodation networks, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 1-14, DOI: 10.23912/9781911396512-3599

Dolnicar, S. and Zare, S. (2020) COVID19 and Airbnb – Disrupting the Disruptor, Annals of Tourism Research, 83, 102961, DOI: 10.1016/j.annals.2020.102961

Ferreri, M. and Sanyal, R. (2018) Platform economies and urban planning: Airbnb and regulated deregulation in London, Urban Studies, 55(15), 3353-3368.

Forgacs, G. and Dolnicar, S. (2018) The impact on employment, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 160-169, DOI: 10.23912/9781911396512-3612

Hajibaba, H. and Dolnicar, S. (2018) Helping when disaster hits, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 235-243, DOI: 10.23912/9781911396512–3619

Halpern, A. (2020) How Airbnb could change after the pandemic – for the better, retrieved on February 16, 2021 from https://www.cntraveler.com/story/how-airbnb-could-change-after-the-pandemic-for-the-better

Ham, L. (2020) What Airbnb hosts are doing to ride out the COVID-19 crisis, retrieved on January 22, 2021 from https://www.domain.com.au/living/what-airbnb-hosts-are-doing-to-ride-out-the-covid-19-crisis-940927

Hardy, A. and Dolnicar, S. (2018a) Types of network members, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 170-181, DOI: 10.23912/9781911396512-3613

Hardy, A. and Dolnicar, S. (2018b) Networks and hosts: a love-hate relationship, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 182-193, DOI: 10.23912/9781911396512-3614

Hossain, M. (2021) The effect of the Covid-19 on sharing economy activities, Journal of Cleaner Production, 280, 124782-124782, DOI: 10.1016/j.jclepro.2020.124782

Hussain, D. and Yaqub, M.Z. (2010) Micro-entrepreneurs: Motivations, success factors, and challenges, International Research Journal of Finance and Economics, 56, 22-28.

Inside Airbnb (2020) London, retrieved on June 18, 2020 from http://insideairbnb.com/london

Janna (2017) How do I find a co-host in my area? Retrieved on January 22, 2021 from https://community.withairbnb.com/t5/Help/How-do-I-find-a-co-host-in-my-area/td-p/287318

Karlsson, L. and Dolnicar, S. (2016) Someone’s been sleeping in my bed, Annals of Tourism Research, 58, 159-162, DOI: 10.1016/j.annals.2016.02.006

Knezevic Cvelbar, L., Vavpotic, D. and Dolnicar, S. (2021) Resident satisfaction with the growth of Airbnb in Ljubljana – before, during and after COVID-19, in S Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Kokalitcheva, K. (2016) Here’s how Airbnb is expanding its co-hosting program, retrieved on January 22, 2021 from https://fortune.com/2016/11/15/airbnb-co-hosting-launch

Lane, L. (2020) How bad are Covid-19 pandemic effects on Airbnb guests, hosts? Retrieved on January 22, 2021 from https://www.forbes.com/sites/lealane/2020/06/09/how-bad-are-covid-19-pandemic-effects-on-airbnb-guests-hosts/?sh=59087bc67432

Möhlmann, M. (2015) Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again, Journal of Consumer Behaviour, 14(3), 193-207.

Perks, S. and Struwig, M. (2005) Skills necessary to grow micro entrepreneurs into small business entrepreneurs, South African Journal of Economic and Management Sciences, 8(2), 171-186.

Phan, P.H. (2004) Entrepreneurship theory: Possibilities and future directions, Journal of Business Venturing, 19, 617-620.

Sigala, M. (2018) Market formation in the sharing economy: Findings and implications from the sub-economies of Airbnb, in S. Barile, M. Pellicano and F. Polese (Eds.), Social dynamics in a systems perspective, Cham: Springer International Publishing, 159-174.

Sigala, M. and Dolnicar, S. (2018) Entrepreneurship opportunities, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 77-86, DOI: 10.23912/9781911396512–3605

Sonnemaker, T. and Rapier, G. (2020) Airbnb’s IPO filing reveals exactly how the pandemic has devastated its business – and the startup is already projecting a winter decline as COVID-19 cases surge, retrieved on January 22, 2021 from https://www.businessinsider.com.au/airbnb-files-s1-public-ipo-paperwork-revenue-losses-covid-19-2020-11

Stevens, P. (2018) Airbnb acquires Luckey Homes to signal potential entry into property management, retrieved on January 22, 2021 from https://shorttermrentalz.com/news/airbnb-acquires-luckey-homes-to-signal-potential-entry-into-property-management

Stevenson, H.H. and Jarillo, J.C. (1991) A new entrepreneurial paradigm, in A. Etzioni and P. Lawrence (Eds.), Socio-economics: Toward a new synthesis, Armonk, NY: M.E. Sharpe, 185-208.

von Briel, D. and Dolnicar, S. (2021) The evolution of Airbnb’s competitive landscape, in S Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Welter (2012) All you need is trust? A critical review of the trust and entrepreneurship literature, International Small Business Journal: Researching Entrepreneurship, 30(3), 193-212.

Wong, J. (2012) The rise of the micro-entrepreneurship economy, retrieved on August 9, 2018 from: https://www.fastcompany.com/2679903/the-rise-of-the-micro-entrepreneurship-economy

Zare, S. and Dolnicar, S. (2021) Airbnb’s space donation initiatives – before, during and after COVID-19, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.