4 The evolution of Airbnb regulations

Dorine von Briel, Department of Tourism, UQ Business School, The University of Queensland, Australia

Sara Dolnicar, Department of Tourism, UQ Business School, The University of Queensland, Australia

Please cite as: von Briel, D. and Dolnicar, S. (2021) The evolution of Airbnb regulations, in S. Dolnicar (Ed.) Airbnb before, during and after COVID-19, University of Queensland DOI: https://doi.org/10.6084/m9.figshare.14195972

The need to regulate short-term accommodation

When it was small in scale, the trading of tourist accommodation among ordinary people created no difficulties for local residents, tourism destinations, or traditional tourist accommodation providers. In fact, the trading of space among ordinary people existed long before the emergence of online peer-to-peer accommodation platforms such as Airbnb. The Swiss and Dutch teachers’ associations, for example, started their home-swapping program for members in 1950 (Gallagher, 2017). The City Council of Varna in Bulgaria invited residents to open rooms in their homes to tourists in 1896 (Varna Municipality, 1896).

Airbnb’s convenient online peer-to-peer accommodation trading platform suddenly enabled millions of people around the world to sell access to space to strangers. High demand for peer-to-peer accommodation, initially perceived by tourists as cheaper and more authentic than traditional tourist accommodation, led to substantial structural changes at destinations around the world, especially at popular tourist destinations. Landlords in the long-term rental market saw the opportunity to earn more money and transitioned to the short-term accommodation market. Residential areas with a traditionally low tourist presence experienced an influx of visitors, affecting the use of space in neighbourhoods originally designed for use by locals only. Established commercial accommodation providers became concerned about unfair competition reducing their market share (von Briel & Dolnicar, 2021).

These changes forced regulators to assess whether existing legislation and regulation offered residents and the local tourism industry adequate protection from negative externalities, while still allowing additional economic benefits to be harvested. Regulating peer-to-peer accommodation proved challenging as most platforms facilitating the trading of private space for short-term accommodation, such as Airbnb, are global organisations operating in local legislative frameworks (Brail, 2017). In many cities, the activities of peer-to-peer accommodation platforms facilitators were breaching existing regulations, in others, their activities were unregulated. Whichever the starting point, the number of listings increased dramatically at locations with high tourist demand, forcing regulators into action. Regulatory approaches varied substantially from location to location because each destination faced a unique tourism demand pattern and a different set of negative side effects. Regulators had to prioritise their goals, which typically included reducing transaction costs, increasing efficiency in the market, promoting equal distribution, and ensuring public safety, as well as health and consumer protection (Lobel, 2018).

The challenges Airbnb created at popular tourist destinations

The emergence of peer-to-peer accommodation networks had positive and negative effects on local communities, and local residents generally acknowledge this fact (Jordan & Moore, 2017). On the positive side, peer-to-peer accommodation networks offer people without permanent (or sufficient) employment the possibility to earn money or to supplement their income by renting out spare space. Beyond hosting itself, a large number of other micro-entrepreneurship opportunities have emerged (Sigala & Dolnicar 2018; Fairley et al., 2021a), including intermediaries between hosts and guests, and services assisting hosts such as cleaning, gardening, pool maintenance, and laundry. The ability to make spaces accessible quickly in a specific location has also proved invaluable in communities facing unexpected disasters, such as earthquakes. Peer-to-peer accommodation platform facilitators are able to offer critically important assistance by accommodating displaced residents and tourists (Hajibaba & Dolnicar, 2017).

Despite all these benefits, the exponential growth of short-term listings at popular tourist destinations created some significant challenges (Dredge & Gyimóthy, 2015; Dolnicar, 2019; Lee, 2016; Oskam & Boswijk, 2016; Hajibaba & Dolnicar, 2018).

Challenges for residents

Tourists using areas designed to be residential can significantly burden local infrastructure. Parking spaces, for example, are suddenly used by residents and tourists. The town planning process had never accounted for this additional demand, causing shortages. The presence of tourists can also change how space is being used, completely transforming the character of the neighbourhood (Zale, 2018; Gurran et al., 2020) and negatively affecting the quality of life of residents. Other aspects causing frustration among residents include additional noise – such as the much-referenced sound of roller suitcases – and safety concerns due to the presence of non-locals with no place attachment or sense of obligation to behave appropriately. People living in apartment blocks experience anxiety because apartment keys for high-security residential buildings can change hands daily (Williams, 2016).

The lucrative business of – often unregulated and unlicensed – short-term accommodation (Lee, 2016; Gurran & Phibbs, 2017) can also affect local real estate markets. Houses and apartments rented out to long-term tenants are repurposed to become short term rentals (Ferreri & Sanyal, 2018; Zale, 2018) which reduces housing availability and affordability for locals (Gurran & Phibbs, 2017; Lambea Llop, 2017; Ferreri & Sanyal 2018; Zale, 2018; Gyodi, 2019), and creates gentrification (Wachsmuth & Weisler, 2018). In New York, for example, property value rose by 6-11% every time the number of Airbnb listings doubled (Sheppard & Udell, 2016), and rental prices increased, especially in wealthier areas (Wachsmuth & Weisler, 2018). Across the entire United States, an increase of Airbnb listings of 1% led to a price rise of 0.018% in rent and 0.026% in house sales (Barron et al., 2018).

Unhosted rentals – spaces available for short-term rental without the host being present – are common, particularly in popular tourist destinations where second homes and apartments are listed when unused (Adamiak, 2018). Unhosted rentals have the most detrimental effect in popular cities with a deficient housing stock. In London, for example, 52% of listings were unhosted in 2016, increasing to 56% in 2020. In 2016, nearly 42% of hosts listed multiple properties. This proportion increased to 49% in 2020 (Ferreri & Sanyal, 2018; Inside Airbnb, 2020). Because landlords believe they can earn more money with unhosted rentals on the short-term rental market than the long-term rental market, long-term tenants can find themselves evicted to make space for tourists (Said, 2014; Comiteau, 2016).

Challenges for destinations

The availability of peer-to-peer accommodation leads to critical structural changes at tourist destinations because Airbnb changes how tourists are distributed within the destination. Tourists use residential areas with inadequate infrastructure for both residents and tourists, putting pressure on regulators in urban (Nieuwland & van Melik, 2018; Sequera & Nofre, 2018) and rural areas (Gurran et al., 2020) to restrict tourist presence or enable town planners to redesign spaces (Palombo, 2015; Guttentag, 2017).

These regulators lacked funding for such responses (Gurran & Phibbs, 2017) because, initially, peer-to-peer accommodation hosts did not pay the same taxes and fees as professional, licensed tourist accommodation providers (Kaplan & Nadler 2015).

Challenges for guests

Given the absence of safety regulations for peer-to-peer accommodation listings, privately traded spaces can increase risks for guests. Commercial, licensed tourist accommodation providers operate in compliance with legal requirements, including building modifications to comply with more stringent health and safety codes and standards (Gurran, 2018; Gurran et al., 2018). When peer-to-peer accommodation initially became accessible to the masses, such regulations did not apply to Airbnb hosts. Many argued that staying at spaces listed on peer-to-peer accommodation network platforms, therefore, was not safe for tourists (Guttentag, 2015; Heo, 2016; Guttentag, 2017).

Another challenge for guests is accessibility for those with special needs. Policymakers in many countries require commercial, licensed tourist accommodation providers to have a minimum number of accessible rooms. These rooms can accommodate people with special needs, providing, for example, wheelchair access or brail labelling. No such requirements exist for listings on peer-to-peer accommodation network platforms, although some platform facilitators, such as Airbnb, have made attempts to provide more information about the accessibility of properties, allowing people with impairments to better assess the suitability of a space for their needs (Randle & Dolnicar 2018; 2019; 2021).

Challenges for traditional, licensed short-term accommodation providers

When regulations for hosts of peer-to-peer accommodation and commercial, licensed tourism accommodation providers are not the same (Koh & King, 2017; Hajibaba & Dolnicar, 2018) licensed providers feel severely disadvantaged. Complying with regulations translates to additional business expenses. Licensed premises have to pay tourist taxes, set up accessible rooms, and pay electricians to install and regularly check smoke detectors and carbon monoxide detectors (Staley, 2007; Guttentag, 2017; Dolnicar, 2019). As peer-to-peer accommodation hosts do not need to pay these expenses, they are able to keep their prices low, giving them a competitive advantage over commercial, licensed providers (Davidson & Infranca 2018).

Professional accommodation providers also have to comply with employment standards and regulations. Airbnb does not employ its service providers, relying instead on a network of micro-entrepreneurs without employment contracts (Sigala & Dolnicar 2018). The high demand for Airbnb-listed properties has impacted employment arrangements in the hospitality sector (Acevedo, 2016; Forgacs & Dolnicar, 2018; Fang et al., 2016) and reduced daily wages (Suciu, 2016).

Regulatory responses

Regulatory responses are local in nature; they need to account for the specific circumstances and challenges at a given destination. The best way to illustrate a range of regulatory responses, therefore, is to briefly describe developments in a few locations around the world. We focus on cities located in different continents that have been significantly affected by the rise in popularity of Airbnb and similar peer-to-peer accommodation platform facilitators: Amsterdam, Barcelona, Berlin, Hobart, London, New York, Paris, Reykjavík, San Francisco and Tokyo. These destinations are not a representative subset of destinations around the world. Rather, they are destinations that are very popular among tourists. It is for this reason that they are most affected by the rising popularity of peer-to-peer accommodation, and have been forced to put in place regulations to minimise negative externalities, while attempting to still harvest the economic benefits for residents offered by short-term accommodation.

Amsterdam (The Netherlands)

When Airbnb started operating in Amsterdam in 2008, peer-to-peer accommodation was unregulated. The lack of regulation did not deter hosts. In 2013, a judge ruled that a homeowner who was renting their property on the short-term rental market did so illegally because they were using a residential property as a business. This legal precedent forced regulators to develop a clear position on peer-to-peer accommodation, leading to the introduction of a regulatory framework in 2014 containing a new accommodation category referred to as private rental. The new framework limited the number of guests to four at a time and limited unhosted renting to a maximum of 60 days per annum. It did not impose a time limit on hosted rentals and spaces covering less than 40% of the host’s primary residence (MOU, 2014). The City of Amsterdam chose to adopt a collaborative approach with Airbnb, a strategy that remains in place today. Collaboration is part of the legislation via a memorandum of understanding (MOU, 2014). Memoranda are renegotiated annually, with all peer-to-peer platform facilitators contributing to solve newly emerging challenges.

Collaboration was taken to the next level with Airbnb collecting a 5% tourist tax on behalf of the government (Airbnb, 2015). But when platform facilitators refused to share their data, the City of Amsterdam – independently of Airbnb – introduced a mandatory registration system linking hosts to their national identification number (City of Amsterdam, 2017). A 2016 memorandum introduced a tool to tackle illegal hotels (MOU, 2016), and platform facilitators limited short-term rental activity to 60 days per property for hosts without a business licence. Airbnb also started promoting its new neighbour tool which residents in Amsterdam could use to share specific concerns about a listing, including noise complaints. This was in response to Amsterdam residents starting to experience negative externalities, such as changes to their neighbourhood, and rising housing prices. In 2017, it was estimated that 6,000 active listings on Airbnb in Amsterdam were illegal (Van Heerde, 2017), leading to a drive to end non-compliant short-term letting.

The agreement negotiated for 2017 and 2018 included new tools to block illegal hosts on trading platforms, and a 24/7 hotline for residents to report delinquent guests or hosts to the City of Amsterdam directly. The City of Amsterdam and Airbnb jointly campaigned to promote local rules, responsible home sharing and how to be a good guest in Amsterdam. From 2018, Amsterdam increased the tourist tax for peer-to-peer accommodation to 6%, and capped the number of licences for hosts registered as bed and breakfasts (professional hosted rentals, with no limit on annual days of operation) to 5% per neighbourhood and 25% per building. In 2019, unhosted renting activity was limited to a maximum of 30 days, and the tourist tax increased to 7%. Hosts had to notify the City of Amsterdam every time they rented out their home.

2020 heralded a new era for peer-to-peer accommodation in Amsterdam. Before the COVID-19 pandemic, the city council raised the tourist tax to 10% (City of Amsterdam, 2020a), and attempted to legally ban short-term rental activity in three districts: Haarlemmerstraat, Kinkerstraat and Red Light. To achieve the ban, the council had to prove that peer-to-peer accommodation was endangering residents. In April 2020 – despite the reduced number of tourists due to COVID-19 – the court ruled in favour of the City of Amsterdam, banning Airbnb from the city centre from 1 July. For all other districts, a licensing system will be introduced (DutchNews, 2020). In response to the COVID-19-induced drop in demand, Amsterdam temporarily abandoned the system of limited permits for bed and breakfasts (City of Amsterdam, 2020b).

Amsterdam is an interesting case because of its proactive approach to regulating peer-to-peer accommodation on a continuous basis, and its strategy of working collaboratively with platform facilitators, users and residents. The annual review system ensures that regulation stays up to date and responds to emerging challenges and opportunities.

Barcelona (Spain)

In 2012, when peer-to-peer accommodation trading commenced in Barcelona, short-term letting was unregulated. Barcelona reacted promptly by introducing a small nightly tourist tax (Catalonia News, 2012) and a free registration system. All hosts were added to the Tourism Registry of Catalonia, enabling local councils to monitor the number of listings (Portal Juridic de Catalunya, 2012). The registration process was the same for all accommodation providers: hotels, bed and breakfasts, and peer-to-peer accommodation hosts. The quick regulatory response is attributed to the level of collaboration and communication between the Tourism Department of Barcelona and Barcelona City Council. The latter immediately developed a plan to manage tourism for the next three years (INSETUR, 2014). Like Amsterdam, Barcelona put in place regulations quickly, but with the intention to review and adapt them on an ongoing basis. Barcelona’s tourism plan is a key regulatory tool, instrumental in managing tourism in the city and informed by research from the Higher Institute for Tourism Research at the University of Girona. The aim of the regular tourism planning process is to encourage ongoing debate with all stakeholders in view of achieving the common goal of consolidating Barcelona as a key tourist destination in a sustainable and responsible manner.

Over time, Barcelona started to experience a large increase in listings, causing negative externalities to local residents. In response, in 2015, Barcelona City Council froze the number of tourism licences allocated to short-term rentals (Espiga, 2014), imposed a €60,000 fine on peer-to-peer accommodation network platform facilitators listing unregistered properties (Lomas, 2016), and created the City and Tourism Council. Experts, citizens, municipal groups, and relevant representatives from Barcelona City Council collaborated on future tourism proposals (Barcelona, 2016). In 2016, the city’s tourism plan granted 9,606 tourism accommodation licences in Barcelona, covering both peer-to-peer accommodation and traditional tourist accommodation. With 15,881 spaces listed that year, 6,275 were illegal (Lomas, 2016). Improved compliance, therefore, was the focus of the 2017 tourism plan. Teams of inspectors started policing the legality of peer-to-peer accommodation listings. Airbnb, in collaboration with Barcelona City Council, deactivated 1,300 illegal listings (Airbnb Citizen, 2017), and limited hosting to one property per host in the central Barcelona area. Barcelona extended the licence freeze indefinitely, and increased the maximum fine for illegal listings to €600,000 (Lomas, 2016).

In 2018, Airbnb agreed to share listing details with city authorities, enabling the identification of illegal listings (O’Sullivan, 2018). The city published good practice guidelines for users of peer-to-peer accommodation in 2019, but kept the number of licences frozen. In the same year, Barcelona City Council’s 2020 Strategic Tourism Plan included action points to achieve urban balance, improve environmental sustainability, maximise benefits for the destination and involve the entire community. The plan set out to eradicate illegal accommodation (Barcelona Tourism Plan, 2020), and launched the Tourism Data System operated by the Tourism and Recreation Laboratory at the University of Rovira i Virgili. The Tourism Data System records the number of tourists staying in peer-to-peer accommodation. It shows that more beds are provided by peer-to-peer accommodation trading platforms than by hotels, and that the number of beds on peer-to-peer accommodation platforms is increasing rapidly (Barcelona Tourism Plan, 2020). COVID-19 will lead to adaptations of the tourism plan. Already, Barcelona City Council has announced a desire to leverage the pandemic to limit short-term rentals in view of increasing the availability of long-term rentals for residents (Burgen et al., 2020).

Berlin (Germany)

Although Airbnb started operating in Berlin in 2011, the city did not introduce laws regulating peer-to-peer accommodation until 2014. The 2014 law banned unhosted short-term rentals, while permitting hosted short-term rentals if the rental surface area covers less than 50% of the floor space. The law is called Zweckentfremdungsverbot which translates as the prohibition of using space in unintended ways. Property owners can apply for a permit from their local council to engage in unhosted rental activity, but these requests can be refused (ZwVbG, 2013; ZwVbVO, 2014). Airbnb updated its terms of service on their website immediately, however, the law was introduced with a two-year transition period.

In 2016, Berlin State started proactively enforcing the law by introducing a compulsory annual registration system and a €100,000 fine for non-compliance. The law defined the limits of short-term rentals, but also of unoccupied residential properties and their demolition. The aim of the regulation was to prevent rising property prices and a growing housing shortage in Berlin, and immediately led to the removal of 40% of Berlin’s Airbnb listings (O’Sullivan, 2016).

To spot illegal listings, Berlin relies heavily on residents notifying authorities of non-compliant activity. An attempt to force peer-to-peer accommodation platform facilitators into sharing data with governments failed when a court ruled in Airbnb’s favour in 2018. In the same year, Berlin State updated the Zweckentfremdungsverbot act to explicitly address short-term accommodation trading via peer-to-peer accommodation platforms.

According to the updated act, hosts wanting to list more than 50% of their space or their secondary residence on peer-to-peer accommodation platforms require the permission of the Urban Development and Housing department. This process is free of charge and gives permission for up to 90 days, but is very difficult to obtain because it involves a change of use. The penalty for breaking the rule is €500,000. From 2018 onwards, hosts must publicly display the registration number on the online listing (ZwVbG, 2013), enabling inspectors to check compliance.

Hobart (Australia)

In 2012 when peer-to-peer accommodation trading started in Tasmania, Hobart had regulation for traditional tourist accommodation providers and peer-to-peer hosts, making most private short-term rentals illegal by default. Four years later, the Tasmanian government proposed a 42 day annual cap on unlicensed short-term rentals. Exceeding this limit required compliance with additional planning regulations (Smiley, 2016). Public hearings took place in Hobart, Launceston, and Burnie. Tasmanian Airbnb hosts objected to the 42-day limit (Crawley, 2017), which was ultimately abandoned.

The revised regulatory framework came into effect in July 2017. Under this framework, hosts can list a maximum of four rooms located at their main residence for as many days as they want without a permit (Grimmer et al., 2019). In all other cases, hosts must register, pay a $250 registration fee (Aird & Burgess, 2017) and declare that the space they are listing complies with minimum safety requirements. If the space listed is an investment property larger than 300m2, the property may require a change of use (from residential to visitor accommodation) with the planning office (Tasmanian Government, 2017). If a change is necessary the space must comply with planning directives, including compatibility with the character and use of the area (Planning Directive, 2018).

In 2019, the state of Tasmania introduced an even more drastic change, commencing a data sharing partnership with platform facilitators such as Airbnb. The Short Stay Accommodation Act legislates that hosts must provide data to platform facilitators. They, in turn, must pass it on to the state government (SSA, 2019). This means that in contrast to the other cities studied (that have their own registration systems), the data from Tasmania depends entirely on collaboration with platform facilitators. This is particularly unusual considering that Airbnb was suspected of providing incomplete or modified data to the cities of New York (Fermino, 2015) and London (Ferreri & Sanyal 2018).

London (UK)

When Airbnb started in London, the existing planning laws from 1973 prohibited residential short-term rental. Users acted illegally for five years before regulators changed the law. The British government showed the first signs of opening up to the idea of peer-to-peer accommodation in 2013, when they organised a Round Table of the Sharing Economy with platform facilitators including Airbnb (Ferreri & Sanyal 2018). In 2014, Debbie Wosskow, CEO of the online home-sharing platform Love Home Swap, was commissioned to make recommendations on how the UK could become the global centre of the sharing economy (Wosskow, 2014). A few months later, the first draft of the Deregulation Act was introduced.

The 2015 Deregulation Act legalised short-term rental (Deregulation Act, 2015). Hosts renting out spaces for less than 90 days per year did not require planning permission for unhosted spaces. Peer-to-peer accommodation was also included in the Rent-a-Room scheme created by the national government in 1992 as an incentive for people to rent out their spare rooms. Under this scheme, the first £4,250 earned per year (UK Government, 2018; Memorandum, 2015) is tax free, although the payment of council tax is still required. A year later, the national government raised the Rent-a-Room tax free threshold to £7,500 (Memorandum, 2015; UK Government, 2016). In a collaborative effort, Airbnb established an annual booking limit of 90 days for unhosted listings on its platform in 2017 (Airbnb, 2020). In London, regulation is strict and has not seen much modification over the years.

New York (USA)

When Airbnb started operating in New York in 2008, short-term rental was unregulated. The New York City Multiple Dwelling Law enacted in 2010 by the state of New York (NYC, 2010) changed this status, restricting certain types of housing to permanent residence use only. The law mentions an exception for house guests staying for fewer than thirty days, but this wording is ambiguous, creating a loophole for short-term renting.

In response, the New York City Environmental Control Board proposed an interpretation of the law, saying that hosted listings do not violate the occupancy law. New York State Senator Liz Krueger – the legislation’s primary sponsor – communicated that the law was created to stop landlords from evicting tenants and converting properties to short-term rentals (Krueger, 2014). Yet, many interpreted the New York City Multiple Dwelling Law as a complete prohibition of peer-to-peer accommodation trading because, under the law, landlords, developers, and residential communities in apartment complexes could prohibit peer-to-peer accommodation activities in their dwellings.

The Multiple Dwelling Law was amended in 2011, and unhosted rentals were prohibited entirely. To list unhosted spaces, hosts required a transient rental permit, involving an inspection by city officials to ensure compliance with strict safety standards encompassing electrical, accessibility, lift, and fire safety measures (Ragalie & Gallagher, 2014). The law also prohibited the advertising of illegal listings, facilitated the identification of fraudsters, raised fines, and limited hosted peer-to-peer accommodation to two paying guests at any given time per property (Lazarow, 2015).

Taxation has been at the forefront of regulatory concerns in New York City (Interian, 2016). In 2013, New York City started charging a 5.8% hotel occupancy tax, generating 1% of the city’s tax revenue. New York City’s Department of Finance decided that peer-to-peer accommodation hosts would not be required to pay the hotel occupancy tax (Kaplan & Nadler, 2015). Brian Chesky, one of the co-founders of Airbnb, expressed his desire to pay occupancy tax in an open letter to Mayor Bill de Blasio (Chesky, 2014; Tiku, 2014), but the law remained unchanged and only unhosted rentals are required to pay occupancy tax (NYC, 2020).

By 2014, despite the strict regulation in place, New York State Attorney General Eric Schneiderman suspected that many listings were non-compliant. By going through the courts, Schneiderman obtained data from Airbnb and other parties (Interian, 2016), identifying offences in safety, tax and property law, and a substantial number of illegal listings. Between 2010 and 2014, 72% of Airbnb listings were illegal (Dzieza, 2015). The extent of this illegal activity fuelled objections from the established tourism accommodation sector as well as from residents who were experiencing negative externalities (Dzieza, 2015). Airbnb reverted to lobbying to avoid prosecution (von Briel & Dolnicar, 2021), reaching an agreement with New York State Attorney General Eric Schneiderman. Hosts, rather than Airbnb, would be prosecuted directly for illegal listings. In exchange, Airbnb agreed to provide anonymised host data to the attorney general (Streitfeld, 2014).

The discovery of a large number of illegal listings also led to the refinement of regulations. State Governor Andrew Cuomo increased the fines for illegal short-term rentals to US $1,000 for a first offence, US $5,000 for a second offence, and US $7,500 for a third (Kokalitcheva, 2016). Initially, the fines had a major impact on Airbnb’s listings, dropping from 20,000 to 300 (Gebicki, 2017). Over time, however, the number of listings increased again.

In July 2018, the State of New York attempted to amend the Multiple Dwelling Law again with a bill to regulate short-term rentals (The New York State Senate, 2018). The bill states that short-term online accommodation platform facilitators must provide monthly transaction data. Airbnb, Expedia and HomeAway united to successfully fight the bill, which was blocked by a federal judge just before coming into effect (Weiser & Goodman, 2019). Despite this victory, Airbnb immediately commenced settlement negotiations with the New York City, agreeing to share the anonymised data of illegal hosts (von Briel & Dolnicar, 2021), and more specific data upon request (Airbnb and NYC Agreement, 2019). Despite Airbnb’s collaborative attitude, the government suspected that data provided by Airbnb in the early years was incomplete, and called for more control (Fermino, 2015). Today, post-COVID-19, there are over 50,000 Airbnb listings in New York City, illustrating how the market has adapted to severe restrictions.

Paris (France)

Paris immediately became a successful market for Airbnb when it started operating there in 2012. Negative externalities soon emerged, however, French regulators adopted a wait-and-see approach.

In 2014, Paris was the number one Airbnb destination in Europe, and second in the world. The French government introduced national regulation (ALUR Law, 2014), which could be considered relatively moderate (O’Driscoll, 2015). For a short-term rental to be legal, the new regulation prescribed that it must be the host’s primary residence (where they reside for at least eight months of the year), it cannot be rented out for more than 120 days annually, and must be furnished. Those wanting to rent out their primary residence for longer, or rent out a secondary residence, must register a commercial property.

In 2015, peer-to-peer accommodation platform providers and the city of Paris started to collaborate. Airbnb collected and remitted a nightly tourist tax for the French government; the same tax paid by hotels (de Cardona & Putois, 2015). To increase compliance, the French government amended the law, forcing hosts – from January 2017 onwards – to register their listings with their local city hall and obtain a certification number (ALUR Law, 2016). Hosts who convert residential properties into commercial properties must purchase commercial properties of the same floor area and convert them into residential properties. Airbnb demonstrated its collaboration with the French government by listing only registered properties.

A law introduced in 2018 allows municipalities to set annual caps in view of local requirements, imposes heavy fines on noncompliant hosts, forces hosts to disclose their records to the council upon request, and makes permission of building co-owners compulsory before listing a property (ELAN Law, 2018).

As of 2020, online platform providers must provide yearly rental data to the French tax authorities, including the host’s name, date of birth, and address, any sales made via the platform (for experiences or accommodation), and the payment method used. The French government aims to have these new systems fully functional by the 2024 Paris Olympics, when demand for temporary housing will skyrocket.

Reykjavík (Iceland)

In response to the dramatic increase in tourist numbers (Statistic Iceland, 2020), the Icelandic government introduced strict regulation for short-term rentals in 2007, long before Airbnb entered the market in 2012.

In 2015, the annual number of international tourists visiting Iceland reached one million (Icelandic Tourism Board, 2016), and the number of properties listed on Airbnb was estimated to have increased by 124% in a year (Davies, 2016). This additional accommodation capacity was very welcome at the time, as both Reykjavik and Iceland wanted to benefit from the increased tourist demand (Adamiak, 2018; Cvelbar & Dolnicar, 2018). Despite the strict short-term rental regulations introduced in 2007, approximately 10% of tourists visiting Iceland in 2016 stayed in private accommodation (Icelandic Tourism Board, 2017), and residents started experiencing a shortage of long-term rental properties and an increase in real estate prices (Davies, 2016; Elíasson & Ragnarsson, 2018).

The Icelandic Government responded by putting new regulations in place in 2017. Under a new law, hosts cannot rent out spaces for longer than 90 days or earn more than two million Icelandic króna a year in combined gross rental income (Iceland Government, 2016). The national government also introduced a compulsory annual registration fee of 8,000 Icelandic króna (Iceland Government, 2016). Each registered host is issued with a unique number to display on their Airbnb profile, and must declare each guest staying at a property to the district commissioner. Any rental activity exceeding the 90 day limit, involving the hosting of more than ten people at the same time, or involving more than five rooms, is only legal if the host registered a business (Comiteau, 2016) at a cost of between 32,000 and 263,000 Icelandic króna (depending on whether alcohol and food were provided).

Despite the new law, up to 70% of Airbnb listings were non-compliant (Icelandmag, 2017). Homestay Patrol was established to check compliance, and the law was amended requiring all short-term rentals to be operated as a business. The registration fee was raised to 9,060 Icelandic króna. These regulations remain in place. Iceland does not collaborate with Airbnb on tax collection or the capping of listings to a maximum number of days (Homestay Patrol, personal communication).

San Francisco (USA)

When Airbnb launched in San Francisco in 2008, short-term rental was forbidden by law. However, Airbnb offered job opportunities in the middle of a financial crisis, which attracted supporters among members, the local San Francisco workforce and politicians, including Mayor Ed Lee. Airbnb launched several lobbying campaigns to unite supporters (von Briel & Dolnicar, 2021). Housing activists, led by the City Attorney of San Francisco Dennis Herrera, argued that short-term rentals removed housing stock from a rental market that was already struggling. No regulation was introduced for many years.

In 2014, politicians opposed to Airbnb created draft legislation (referred to as Proposition F) to protect tenants facing eviction because of peer-to-peer accommodation. A legal battle erupted and both parties used the municipal elections to present their positions. The candidate in support of Airbnb, Ed Lee, won the 2015 elections and became mayor. Lee immediately introduced a new short-term rental law that legalised Airbnb (Hamilton & Romney, 2015). The law required hosts to register as a business and pay a registration fee, to complete a biannual registration with the Office of Short-Term Rentals at a cost of US $250, and to pay 14% Transient Occupancy Tax (Airbnb, 2017; San Francisco Business Portal, 2017). With respect to safety, hosts must inform guests – using a sign at the premises –where fire exits, fire alarms, gas shut-off valves, and fire extinguishers are located. The new law did not impose a time limit on hosted rentals, but limited unhosted rentals to 90 days (Airbnb, 2017; San Francisco Business Portal, 2017). Hosting activity was only legal if it occurred at the host’s primary residence; the place they live in for a minimum of 275 days every year.

Many hosts initially ignored the new law, refusing to register their short-term rental activities. An attempt to impose a fine of $1,000 per day on peer-to-peer accommodation platform facilitators for illegal listings was challenged in court by Airbnb and Homeaway. Their case was rejected (Levine & Somerville, 2016). In 2016, a new regulation was introduced, requiring hosts to submit quarterly activity reports to the Office of Short-Term Rentals of San Francisco.

After a year of legal battle, in 2017, Airbnb and regulators reached a collaboration agreement. The city abandoned the fine for illegal listings, and Airbnb committed to listing only registered properties (Farivar, 2017). Airbnb created and launched a Pass-Through Registration system that allows hosts to apply for a Short-Term Residential Rental Certificate and Business Registration Certificate via its platform. Airbnb also became the only Qualified Website Company for short-term rentals in San Francisco, automatically collecting occupancy taxes and remitting them to the city. Hosts using other platform providers (e.g. HomeAway, VRBO) are individually responsible for calculating, collecting, and remitting these taxes to the city for each booking, and have to apply for the short-term rental and business certificates. The level of collaboration between the city of San Francisco and Airbnb is unequalled in the world, but the legal battle with opponents of Airbnb continues.

Despite previous efforts to eradicate illegal short-term rentals, the City Attorney of San Francisco issued fines of US $5.5 million to hosts of illegal Airbnb listings, fuelling criticism against peer-to-peer accommodation platform facilitators. In 2019, a modified Proposition F was approved, limiting the size of financial contribution a company can make to a political campaign, and the level of ownership a politician can have in a company (San Francisco Department of Elections, 2019). This regulation was targeted at San Francisco politicians supporting Airbnb. The Office of Short-Term Rentals raised the biannual registration fee to $450 to finance their activities and the required adaptations to local neighbourhoods (to enable them to better cater to peer-to-peer-hosted tourists). The City of San Francisco announced new legislation, introducing a requirement for planning approval of new buildings intended for intermediate stays (Waxmann, 2019). The legislation targeted a new range of hospitality professionals using peer-to-peer accommodation for corporate travellers. These listings are rented out for longer than 30 days, yet effectively operate as hotels and remove housing stock from the residential market. This regulation was deemed necessary because Airbnb and a new start-up – Sonders – had invested in companies and buildings in San Francisco to pursue the business traveller market (von Briel and Dolnicar, 2021; Burke, 2019). Once more, regulators had taken years to react and struggled to catch up with market changes.

In 2020, COVID-19 changed Airbnb’s business traveller strategy. The new legislation – combined with the pandemic – is likely to lead to investment properties being transitioned (back to) the long-term rental market.

Tokyo (Japan)

Japan has a tradition – called Minshuku – of guests staying at an owner’s home, sharing meals, facilities and lifestyle together. Minshuku has been regulated in Japan since the Second World War under the Hotels and Inns Act (Umeda, 2017). All short-term rentals in Japan were subject to this law before Airbnb started operating (Nippon, 2016). Consequently, when Airbnb entered the Tokyo market in 2012, its activities were illegal. This regulatory status quo lasted for five years.

In 2016, Airbnb launched a lobbying campaign in Tokyo (von Briel & Dolnicar, 2021). The parliament legalised Airbnb in 2017, and introduced the Home-Sharing Business Act in 2018 (Umeda, 2017). Short-term rentals became legal for up to 180 nights per year. The system is called Minpaku (private lodging) and is regulated by local councils (Minpaku, 2020). The extensive registration system includes mental health and fire safety checks. All transactions must be recorded and shared online with the local council. In Tokyo, each council rules separately and differently. Some have banned short-term rentals completely, while others, such as Chuo ward, allow rentals exclusively in school holidays to protect children from strangers (Japan Property Central, 2018). In 2018, Airbnb stopped advertising listings that were not displaying a Minpaku registration number, causing an 80% drop in Tokyo’s Airbnb listings (Johnston, 2018).

In preparation for the Olympic Games (initially scheduled for 2020), Tokyo developed a tourism plan which included sustainable hosting solutions. Airbnb partnered with the International Olympic Committee, guaranteeing accommodation for visitors, families of athletes, and officials during the Games (Asher Hamilton, 2019; Fairley et al., 2021b). This agreement avoided the need to construct new accommodation to meet demand during the event. The city of Tokyo is another example of how a market can adapt and flourish despite tough regulations.

Changes in global regulatory responses over time

Many studies have described the regulatory responses to Airbnb at specific locations at a single point in time (e.g. Lee, 2016; Wegmann & Jiao, 2017; Hajibaba & Dolnicar, 2018; Crommelin et al., 2018; Nieuwland & van Melik, 2018). The evolution of regulatory responses remains under-investigated, despite modifications over time being informative for destinations that are in the process of developing regulations. The longitudinal perspective provides insights into successful and unsuccessful attempts to achieve set goals, using specific measures.

One such analysis monitors regulatory action for 11 cities: Amsterdam, Barcelona, Berlin, Hobart, London, New York, Paris, Reykjavík, San Francisco, Tokyo and Vienna (von Briel & Dolnicar, 2020). Technical innovations such as Airbnb can potentially entice four types of disruptions on regulations: End-runs, when an existing law equivocally covers the innovation; exemptions when the innovation has no negative impact and regulators simply ignore it; gaps when no regulation covers the innovation; and solutions, when the innovation is solving a regulatory issue (Biber et. al, 2017). The cities under investigation suffered negative consequences from Airbnb. As a consequence, they found themselves either in an end-run or gap situation. Regardless of the starting point, all cities converged to a similar solution, as illustrated in Figure 4.1.

Figure 4.1 adapts the point system introduced by von Briel and Dolnicar (2020) for toughness of regulation. We changed the point system to -10 for a gap situation, 0 for a moderate regulation, 10 for end-run, and graded each city each year. We calculated the mean of all end-run cities each year and the mean of all gap cities each year and illustrated the result on a line chart. The two dominant trajectories are illustrated in Figure 4.1. The figure illustrates how, over time, all end-run cities became more lenient, while all gap cities start unregulated and introduce more regulation over time. By 2020, all of the cities studied find themselves in a position of moderately strict regulation.

Host perception of regulations

To measure how hosts perceive regulations which affect their peer-to-peer accommodation trading activity, we surveyed 57 hosts in January 2021. To be eligible to participate in the survey study, respondents had to have listed accommodation on an online peer-to-peer accommodation platform in the last 24 months. We asked respondents if they had proactively sought out information regarding local regulations for short-term accommodation before listing their space on an online platform. In our study, 86% of respondents stated that they did check local regulations. This appears to contradict the high numbers of illegal listings reported in popular tourist destinations. A potential explanation could be that only a small number of hosts are listing illegally but that these hosts list multiple properties. Another interpretation is that hosts are aware of the regulations under which they operate, yet some choose not to comply with them.

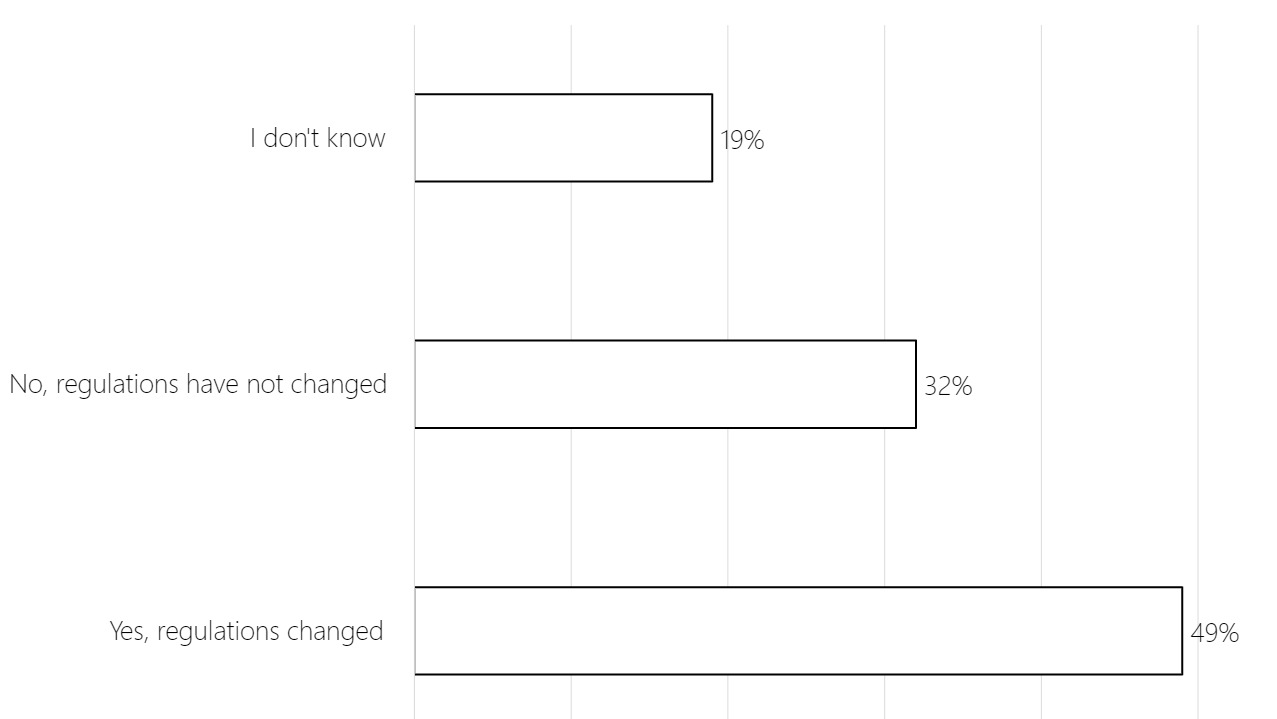

Figure 4.2 shows regulatory changes in response to COVID-19 as perceived by the hosts surveyed in January 2021. Most hosts (49%) reported that the regulations that guide their Airbnb hosting activities have changed. Of those, 75% reported that they have been impacted by stricter regulations; 25% reported that they have not. One third of hosts reported that regulations remained unchanged during COVID-19 compared to before COVID-19, and 19% of hosts confessed that they do not know whether or not regulations have changed.

Post-COVID-19 predictions

COVID-19 interrupted the increase in the trading of short-term rentals between ordinary people using online platforms such as Airbnb.com. With borders closed, major restrictions on travel and the requirement to socially distance, hundreds of thousands of Airbnb-listed spaces suddenly stood idle. Some of Airbnb’s biggest markets – Europe and the United States – were at the COVID-19 epicentre in March 2020 (Adhanom Ghebreyesus, 2020; Rettner, 2020). By August 2020, Airbnb founder Brian Chesky announced that the company had already lost US $1 billion due to lost bookings (Crane, 2020). This financial loss increased further when Airbnb agreed to compensate hosts for COVID-19-related cancellations (Fleetwood, 2020). Chesky voluntarily took a pay cut of US $250,000, and 25% of Airbnb staff had to be laid off.

As soon as lockdowns were lifted, Chesky reports, booking numbers on Airbnb.com increased to numbers higher than those seen in similar periods in 2019. This increase did not occur across all location types. Rather, demand in city locations dropped, while low-population density regional areas – considered by travellers as safer during the pandemic – became extremely popular (Transparent, 2020). Interestingly, according to a report from AirDNA, bookings for home rentals have recovered faster than those for hotels (Press, 2020).

In response to the challenges experienced in 2020, Chesky rethought Airbnb’s future strategy, concluding that it would focus on independent hosts (as opposed to large operators) and put more emphasis on developing listings in less populated areas (Crane, 2020). Both of these initiatives limit the negative externalities that popular city destinations tend to experience, and maximise the economic benefits from Airbnb for regional communities in desperate need of employment opportunities. Post-COVID-19, Airbnb may well find itself moving back to its roots; the trading of space in people’s primary residences (Dolnicar & Zare, 2020).

Chesky’s change of strategy may also reflect the increasing inclination of popular city destinations to tighten short-term letting regulations – a major risk to the company’s growth (Vinogradov et al., 2020). The deputy mayors of Barcelona and Paris – Janet Sanz and Ian Brossa – applauded this change and expressed their desire to boost the long-term housing market with empty short-term rental properties (Burgen et al., 2020). This is in line with a broader trend of policy makers leveraging COVID-19 to reclaim their cities and fight the gentrification caused by the large-scale trading of peer-to-peer accommodation (Bevins, 2020; DutchNews, 2020).

COVID-19 may well lead investors – who were attracted to the short-term rental market by the prospect of a higher return on investment – back to the long-term rental market to minimise the risk of significantly reduced returns (as predicted by Dolnicar & Zare, 2020). Chesky’s comments reflect these predictions; he expects that (1) the travel market will never go back to what it was; (2) the business travel market will shrink in size dramatically because people have realised they can achieve the same results without travelling; and (3) people will want to travel locally, by car, to nature, with people they care about (Chang, 2020). It will be interesting to see if the new focus on regional locations increases economic benefits, or shifts some of the challenges residents of cities have experienced to regional areas. This may depend on whether the regional locations are, in their own right, popular tourist destinations, or regional areas suffering from a lack of employment and business opportunities.

As for Airbnb, its revenue is increasing again as travel restrictions are relaxed. The company has regained its confidence and, in August 2020, announced that it would file to go public (Griffith, 2020). Regardless of regulations and potential new regulatory challenges, Airbnb sees a bright future ahead.

Acknowledgements

This chapter is based on Hajibaba, H. and Dolnicar, S. (2018) Regulatory reactions around the world, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 120-136.

Survey data collection in 2021 was approved by the University of Queensland Human Ethics Committee (approval number 2020001659).

We thank Egill Ólafsson, Specialist at the Homestay Patrol in Reykjavik for their collaboration.

References

Acevedo, D.D. (2016) Regulating employment relationships in the sharing economy, Employee Rights and Employment Policy Journal, 20, 1-35.

Adamiak, C. (2018) Mapping Airbnb supply in European cities, Annals of Tourism Research, 71, 67-71, DOI: 10.1016/j.annals.2018.02.008

Adhanom Ghebreyesus, T. (2020) WHO director-general’s opening remarks at the media briefing on COVID-19 – 13 March 2020, retrieved on August 28, 2020 from https://www.who.int/dg/speeches/detail/who-director-general-s-opening-remarks-at-the-mission-briefing-on-covid-19—13-march-2020

Airbnb and NYC Agreement (2019) Exhibit 2-5-14-19 agreement, retrieved on March 26, 2020 from https://www.scribd.com/document/411366884/Exhibit-2-5-14-19-Agreement

Airbnb (2015) Amsterdam and Airbnb sign agreement on home sharing and tourist tax, retrieved on March 31, 2020 from https://www.airbnb.com.au/press/news/amsterdam-and-airbnb-sign-agreement-on-home-sharing-and-tourist-tax

Airbnb (2017) San Francisco, CA, retrieved on April 22, 2020 from https://www.airbnb.com.au/help/article/871/san-francisco–ca

Airbnb (2020) I rent out my home in London, retrieved on March 30, 2020 from https://www.airbnb.com/help/article/1340/i-rent-out-my-home-in-london-what-shortterm-rental-laws-apply

Airbnb Citizen (2017) Working together: Airbnb and Barcelona city hall, retrieved on May 5, 2020 from https://barcelona.airbnbcitizen.com/working-together-airbnb-and-barcelona-city-hall

Aird, H. and Burgess, G. (2017) Tasmania eases Airbnb regulations for renting out rooms in sharing economy, retrieved on May 5, 2020 from http://www.abc.net.au/news/2017-02-03/tasmanian-government-lifts-red-tape -on-airbnb-rentals/8239486

ALUR Law (2014) Loi n° 2014-366 du 24 mars 2014 pour l’accès au logement et un urbanisme rénové, retrieved on March 30, 2020 from https://www.legifrance.gouv.fr/affichTexte.do?cidTexte=JORFTEXT000028772256&categorieLien=id

ALUR Law (2016) Loi n° 2016-1321 du 7 octobre 2016 pour une république numérique, retrieved on February 28, 2020 from https://www.legifrance.gouv.fr/affichTexte.do;jsessionid=5BE059D79D8DBB5AC10F0AC9E03145CD.tplgfr28s_3?cidTexte=JORFTEXT000033202746&categorieLien=id

Asher Hamilton, I. (2019) Airbnb is sponsoring the Olympics until 2028 for a reported $500 million, retrieved on April 15, 2020 from https://www.businessinsider.com/airbnb-wins-reported-500-million-partnership-for-the-2020-tokyo-olympics-2019-11?IR=T

Barcelona Tourism Plan (2020) Barcelona tourism for 2020 – A collective strategy for sustainable tourism, retrieved on May 5, 2020 from https://ajuntament.barcelona.cat/turisme/sites/default/files/barcelona_tourism_for_2020.pdf

Barcelona (2016) Tourism council, retrieved on April 2, 2020 from https://ajuntament.barcelona.cat/turisme/en/tourism-council/what-it

Barron, K., Kung, E. and Proserpio, D. (2018) The sharing economy and housing affordability: Evidence from Airbnb, retrieved on October 13, 2020 from https://ssrn.com/abstract=3006832

Bevins, V. (2020) The European cities using the pandemic as a cure for Airbnb, retrieved on August 28, 2020 from https://nymag.com/intelligencer/2020/08/in-europe-covid-19-is-an-opportunity-to-regulate-airbnb.html

Biber, E., Light, S.E., Ruhl, J.B. and Salzman, J. (2017) Regulating business innovation as policy disruption: From the model T to Airbnb, Vanderbilt Law Review, 70(5), 1561-1626.

Brail, S. (2017) Promoting innovation locally: Municipal regulation as barrier or boost? Geography Compass, 11(12).

Burgen, S., Henley, J. and Caroll, R. (2020) Airbnb slump means Europe’s cities can return to residents, say officials, retrieved on August 28, 2020 from http://www.theguardian.com/technology/2020/may/09/airbnb-slump-europe-cities-residents-barcelona-dublin.

Burke, K. (2019) S.F. officials look to regulate city’s burgeoning extended-stay rental market, retrieved on March 27, 2020 from https://www.bizjournals.com/sanfrancisco/news/2019/10/24/extended-stay-rental-sf-regulate-airbnb-sonder.html.

Catalonia News (2012) Parliament of Catalonia OKs tourist tax, retrieved on April 1, 2020 from http://www.visitblanes.com/381-parliament-of-catalonia-oks-tourist-tax

Chang, E. (2020) Airbnb CEO Brian Chesky on ‘bloomberg studio 1.0’, retrieved on September 9, 2020 from https://www.bloomberg.com/news/videos/2020-07-10/airbnb-ceo-brian-chesky-on-bloomberg-studio-1-0-video

Chesky, B. (2014) The $21 million problem, retrieved on March 23, 2020 from http://www.huffingtonpost.com/brian-chesky/the-21-million-problem-b5149190.html

City of Amsterdam (2017) Agreement Amsterdam and Airbnb, retrieved on March 31, 2020 from https://sharingcitiesalliance.knowledgeowl.com/help/agreement-amsterdam-and-airbnb

City of Amsterdam (2020a) Tourist tax (toeristenbelasting), retrieved on March 31, 2020 from https://www.amsterdam.nl/en/municipal-taxes/tourist-tax-(toeristenbelasting)

City of Amsterdam (2020b) No lottery needed for b&b permits, retrieved on March 31, 2020 from https://www.amsterdam.nl/en/news/lottery-needed-permits

Comiteau, L. (2016) Is Airbnb making it impossible to find a house? retrieved on May 1, 2020 from http://www.bbc.com/capital/story/20160811-is-airbnb-making-it-impossible-to-find-a-house

Crane, E. (2020) Airbnb’s founder estimates they’ve lost $1 billion during COVID, retrieved on August 28, 2020 from https://www.dailymail.co.uk/news/article-8617085/Airbnbs-founder-estimates-theyve-lost-1billion-COVID.html

Crawley, J. (2017) No restrictions on mum-and-dad Airbnb operators under new plan proposed by Tasmanian Opposition, retrieved on March 23, 2020 from http://www.themercury.com.au/lifestyle/no-restrictions-on-mumanddad-airbnb-operators-under-new-plan-proposed-by-tasmanian-opposition/news-story/e9f49fe749db130aa2f810623f10b2b5

Crommelin, L., Troy, L., Martin, C. and Pettit, C. (2018) Is Airbnb a sharing economy superstar? Evidence from five global cities, Urban Policy and Research, 36(4), 429-444, DOI: 10.1080/08111146.2018.1460722

Cvelbar, L.K. and Dolnicar, S. (2018) Filling infrastructure gaps, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 98-108, DOI: 10.23912/9781911396512-3607

Davidson, N. and Infranca, J. (2018) The place of the sharing economy, in N. Davidson, M. Finck and J. Infranca (Eds.), The Cambridge Handbook of the Law of the Sharing Economy, Cambridge: Cambridge University Press, 205-219.

Davies, C. (2016) Iceland plans Airbnb restrictions amid tourism explosion, retrieved on August 15, 2017 from https://www.theguardian.com/world/2016/may/30/iceland-plans-airbnb-restrictions-amid-tourism-explosion

De Cardona, H. and Putois, A. (2015) Airbnb agrees to collect tourist tax for the city on its rental properties in Paris, retrieved on March 30, 2020 from https://parispropertygroup.com/blog/2015/airbnb-agrees-collect-tourist-tax-city-rental-properties-paris

Deregulation Act (2015) Deregulation Act 2015, retrieved on March 30, 2020 from http://www.legislation.gov.uk/ukpga/2015/20/pdfs/ukpga_20150020_en.pdf

Dolnicar, S. and Zare, S. (2020) COVID19 and Airbnb – Disrupting the Disruptor, Annals of Tourism Research, 83, 102961, DOI: 10.1016/j.annals.2020.102961

Dolnicar, S. (2019) A review of research into paid online peer-to-peer accommodation: Launching the Annals of Tourism Research curated collection on peer-to-peer accommodation, Annals of Tourism Research, 75, 248-264, DOI: 10.1016/j.annals.2019.02.003

Dredge, D. and Gyimóthy, S. (2015) The collaborative economy and tourism: Critical perspectives, questionable claims and silenced voices, Tourism Recreation Research, 40(3), 286-302.

DutchNews (2020) Amsterdam to ban Airbnb in city centre, bring in permits for holiday rentals, retrieved on September 15, 2020 from https://www.dutchnews.nl/news/2020/04/amsterdam-to-ban-airbnb-in-city-centre-bring-in-permits-for-holiday-rentals

Dzieza, J. (2015) Airbnb under fire, retrieved on May 5, 2020 from http://www.theverge.com/2015/1/21/7865959/airbnb-under-fire-new-york-city-city-council

ELAN Law (2018) Loi n° 2018-1021 du 23 novembre 2018 portant évolution du logement, de l’aménagement et du numérique, retrieved on March 30, 2020 from https://www.legifrance.gouv.fr/affichTexte.docidTexte=JORFTEXT000037639478&categorieLien=id

Elíasson, L. and Ragnarsson, O. (2018) Short-term renting of residential apartments. Effects of Airbnb in the Icelandic housing market, Department of Economics, Central Bank of Iceland, Economics working paper 76.

Espiga, F. (2014. Barcelona licence freeze, retrieved on April 1, 2020 from https://www.cataloniatoday.cat/article/106-news-today/872978-barcelona-licence-freeze.html

Fang, B., Ye, Q. and Law, R. (2016) Effect of sharing economy on tourism industry employment, Annals of Tourism Research, 57(3), 264-267.

Fairley, S., Babiak, K., MacInnes, S. and Dolnicar, S. (2021a) Hosting and co-hosting on Airbnb – before, during and after COVID-19, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Fairley, S., MacInnes, S. and Dolnicar, S. (2021b) Airbnb and events – before, during and after COVID-19, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Farivar, C. (2017) San Francisco, Airbnb settle lawsuit over new short-term rental law, retrieved on October 23, 2020 from https://arstechnica.com/tech-policy/2017/05/san-francisco-airbnb-settle-lawsuit-over-new-short-term-rental-law

Fermino, J. (2015) Airbnb releases data on NYC apartments, retrieved on February 28, 2020 from https://www.nydailynews.com/new-york/nyc-airbnb-users-breaking-law-report-article-1.2451722

Ferreri, M. and Sanyal, R. (2018) Platform economies and urban planning: Airbnb and regulated deregulation in London, Urban Studies, 55(15), 3353-3368.

Fleetwood, C. (2020. Airbnb commits $400m to hosts to cover COVID-19 cancellations, retrieved on August 28, 2020 from https://www.travelweekly.com.au/article/airbnb-commits-400m-to-hosts-to-cover-covid-19-cancellations

Forgacs, G. and Dolnicar, S. (2018) The impact on employment, in S. Dolnicar (Ed.), Peer-to-peer accommodation networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 160-169, DOI: 10.23912/9781911396512-3612

Gallagher, L. (2017) The Airbnb story, New York: Hughton Mifflin Hartcourt.

Gebicki, M. (2017) Major blow for Airbnb users, retrieved on August 28, 2020 from http://www.theherald.com.au/story/4444330/major-blow-for-airbnb-users-new-law-to-restrict-new-york-city-apartment-rentals

Griffith, E. (2020) Airbnb, a ‘sharing economy’ pioneer, files to go public, retrieved on August 28, 2020 from https://www.nytimes.com/2020/08/19/technology/airbnb-ipo.html

Grimmer, L., Vorobjovas-Pinta, O. and Massey, M. (2019) Regulating, then deregulating Airbnb: The unique case of Tasmania (Australia), Annals of Tourism Research, 75, 304-307, DOI: 10.1016/j.annals.2019.01.012

Gurran, N. and Phibbs, P. (2017) When tourists move in: How should urban planners respond to Airbnb? Journal of the American Planning Association, 83(1), 80-92.

Gurran, N. (2018) Global home-sharing, local communities and the Airbnb debate: A planning research agenda, Planning Theory & Practice, 19(2), 298-304, DOI: 10.1080/14649357.2017.1383731

Gurran, N., Searle, G. and Phibbs, P. (2018) Urban planning in the age of airbnb: Coase, property rights, and spatial regulation, Urban Policy and Research, 36(4), 399-416, DOI: 10.1080/08111146.2018.1460268

Gurran, N., Zhang, Y. and Shrestha, P. (2020) ‘Pop-up’ tourism or ‘invasion’? Airbnb in coastal Australia, Annals of Tourism Research, 81, 102845, DOI: 10.1016/j.annals.2019.102845

Guttentag, D. (2015) Airbnb: Disruptive innovation and the rise of an informal tourism accommodation sector, Current Issues in Tourism, 18(12), 1192-1217.

Guttentag, D. (2017) Regulating innovation in the collaborative economy: An examination of Airbnb’s early legal issues, in D. Dredge and S. Gyimóthy (Eds.), Collaborative Economy and Tourism: Perspectives, Politics, Policies and Prospects, Cham: Springer International Publishing, 97-128.

Gyodi, K. (2019) Airbnb in European cities: Business as usual or true sharing economy? Journal of Cleaner Production, 221, 536-551, DOI: 10.1016/j.jclepro.2019.02.221

Hajibaba, H. and Dolnicar, S. (2017) Residents open their homes to tourists when disaster strikes, Journal of Travel Research, 56(8), 1065-1078, DOI: 10.1177/0047287516677167

Hajibaba, H. and Dolnicar, S. (2018) Regulatory reactions around the world, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 120-136, DOI: 10.23912/9781911396512-3609

Hamilton, M. and Romney, L. (2015) Airbnb wins in San Francisco, and so does Mayor Ed Lee, retrieved on August 28, 2020 from https://www.latimes.com/local/lanow/la-me-ln-sf-results-airbnb-ballot-measure-20151103-story.html

Heo, C. Y. (2016) Sharing economy and prospects in tourism research, Annals of Tourism Research, 58, 166-170, DOI: 10.1016/j.annals.2016.02.002

Iceland Government (2016) Regulation about restaurants, accommodation and entertainment, retrieved on May 1, 2020 from https://www.stjornartidindi.is/Advert.aspx?RecordID=7b2e5340-6ca8-4607-991c-dce6bee0b326

Icelandic Tourism Board (2016) Tourism in Iceland in figures, retrieved on May 1, 2020 from https://www.ferdamalastofa.is/static/files/ferdamalastofa/Frettamyndir/2016/juni/tourism_-in_iceland_in_figures_may2016.pdf

Icelandic Tourism Board (2017) Tourism in Iceland in figures, retrieved on May 1, 2020 from https://www.ferdamalastofa.is/static/files/ferdamalastofa/Frettamyndir/2017/juli/tourism-in-iceland-2017-9.pdf

Icelandmag (2017) Authorities believe 15% of the most active Airbnb operators in Iceland are tax cheats, retrieved on October 23, 2020 from https://icelandmag.is/article/authorities-believe-15-most-active-airbnb-operators-iceland-are-tax-cheats

INSETUR (2014) Barcelona’s tourism activity: development and management, retrieved on August 28, 2020 from https://ajuntament.barcelona.cat/turisme/sites/default/files/documents/141204_barcelonas_tourism_activity_0.pdf

Inside Airbnb (2020) London, retrieved on August 28, 2020 from http://insideairbnb.com/london/#

Interian, J. (2016) Up in the air: Harmonizing the sharing economy through Airbnb regulations, Boston College International & Comparative Law Review, 39, 129-161.

Japan Property Central (2018) Tokyo’s Chuo ward to ban Minpaku rentals 5 nights a week, retrieved on May 1, 2020 from https://japanpropertycentral.com/2018/01/tokyos-chuo-ward-to-ban-minpaku-rentals-5-nights-a-week

Johnston, E. (2018) Airbnb drops nearly 80 percent of its private home listings ahead of new peer-to-peer rental law, retrieved on May 1, 2020 from https://www.japantimes.co.jp/news/2018/06/06/business/airbnb-drops-nearly-80-percent-private-home-listings-ahead-new-peer-peer-rental-law

Jordan, E.J. and Moore, J. (2017) An in-depth exploration of residents’ perceived impacts of transient vacation rentals, Journal of Travel & Tourism Marketing, 35(1), 1-12.

Kaplan, R.A. and Nadler, M.L. (2015) Airbnb: A case study in occupancy regulation and taxation, University of Chicago Law Review, 82(1), 7.

Koh, E. and King, B. (2017) Accommodating the sharing revolution: A qualitative evaluation of the impact of Airbnb on Singapore’s budget hotels, Tourism Recreation Research, DOI: 10.1080/02508281.2017.1314413

Kokalitcheva, K. (2016) Airbnb changes its tune in New York, retrieved on March 25, 2020 from http://fortune.com/2016/12/06/airbnb-drops-ny-lawsuit

Krueger, L. (2014) Answers for New Yorkers concerned or confused about the illegal hotel law, retrieved on March 26, 2020 from https://www.nysenate.gov/newsroom/articles/liz-krueger/answers-new-yorkers-concerned-or-confused-about-illegal-hotel-law

Lambea Llop, N. (2017) A policy approach to the impact of tourist dwellings in condominiums and neighborhoods in Barcelona, Urban Research & Practice, 10(1), 120-129.

Lazarow, A. (2015) Airbnb in New York City: Law and policy challenges, International Journal of Knowledge and Innovation in Business, 2(3), 24-52.

Lee, D. (2016) How Airbnb short-term rentals exacerbate Los Angeles’s affordable housing crisis: analysis and policy recommendations, Harvard Law and Policy Review, 10, 229-253.

Levine, D. and Somerville, H. (2016) Judge rejects Airbnb’s bid to halt San Francisco ordinance, retrieved on April 5, 2020 from http://www.reuters.com/article/us-airbnb-sanfrancisco-ruling/judge-rejects-airbnbs-bid-to-halt-san- francisco-ordinance-idUSKBN1332OE

Lobel, O. (2018) Coase and the platform economy, in N. Davidson, M. Finck and J. Infranca (Eds.), The Cambridge Handbook of the Law of the Sharing Economy, Cambridge: Cambridge University Press, 67-77, DOI: 10.1017/9781108255882.006

Lomas 2016 Airbnb faces fresh crackdown in Barcelona as city council asks residents to report ilegal rentals, retrieved on August 28, 2020 from https://techcrunch.com/2016/09/19/airbnb-faces-fresh-crackdown-in-barcelona-as-city-council-asks-residents-to-report-illegal-rentals

MacInnes, S., Randle, M. and Dolnicar, S. (2021) Airbnb catering to guests with disabilities – before, during and after COVID-19, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Memorandum (2015) Explanatory memorandum to the income tax order 2015, retrieved on March 30, 2020 from http://www.legislation.gov.uk/uksi/2015/1539/pdfs/uksiem_20151539_en.pdf

Minpaku (2020) FAQ, retrieved on April 22, 2020 from http://www.mlit.go.jp/kankocho/minpaku/faq_en.html

MoU (2014) Memorandum of understanding, retrieved on March 30, 2020 from https://www.binnenlandsbestuur.nl/Uploads/2016/2/2014-12-airbnb-ireland-amsterdam-mou.pdf

MoU (2016) Memorandum of understanding, retrieved on March 31, 2020 from https://sharingcitiesalliance.knowledgeowl.com/help/mou-comprehensive-agreement

Nieuwland, S. and van Melik, R. (2018) Regulating Airbnb: how cities deal with perceived negative externalities of short-term rentals, Current Issues in Tourism, 23(7), 811-825, DOI: 10.1080/13683500.2018.1504899

Nippon (2016) “Minshuku” (traditional family-run lodgings), retrieved on April 28, 2020 from https://www.nippon.com/en/features/jg00050/minshuku-traditional-family-run-lodgings.html

NYC (2010) Multiple dwelling law, retrieved on October 22, 2020 from https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwitjZPDs8fsAhVGAXIKHV2NCAsQFjACegQIAxAC&url=https%3A%2F%2Fwww1.nyc.gov%2Fassets%2Fbuildings%2Fpdf%2FMultipleDwellingLaw.pdf&usg=AOvVaw2PNM-tzKpIU60-2jboGzRS

NYC (2020) Hotel room occupancy tax, retrieved on October 22, 2020 from https://www1.nyc.gov/site/finance/taxes/business-hotel-room-occupancy-tax-faq.page

O’Driscoll, E. (2015) In numbers: How Airbnb has conquered Paris, retrieved on March 30, 2020 from https://www.thelocal.fr/20151002/in-numbers-how-airbnb-has-conquered-paris

O’Sullivan, F. (2016) Europe’s crackdown on Airbnb, retrieved on May 5, 2020 from https://www.citylab.com/equity/2016/06/european-cities-crackdown-airbnb/487169

O’Sullivan, F. (2018) Barcelona finds a way to control its Airbnb market, retrieved on May 5, 2020 from https://www.citylab.com/life/2018/06/barcelona-finds-a-way-to-control-its-airbnb-market/562187

Oskam, J. and Boswijk, A. (2016) Airbnb: The future of networked hospitality businesses, Journal of Tourism Futures, 2(1), 22-42.

Palombo, D. (2015). A tale of two cities: the regulatory battle to incorporate short-term residential rentals into modern law (New York City and San Francisco), American University Business Law Review, 4(2), 321.

Planning Directive (2018) Planning directive no. 6 – Exemption and standards for visitor accommodation in planning schemes, retrieved on November 11, 2020 from https://www.planningreform.tas.gov.au/__data/assets/pdf_file/0007/441493/Planning-Directive-No.6-Exemption-and-Standards-for-Visitor-Accommodation-in-Planning-Schemes-as-modified-1-August-2018.pdf

Portal Juridic de Catalunya (2012) DECRET 159/2012, de 20 de Novembre, retrieved on April 1, 2020 from https://portaljuridic.gencat.cat/ca/pjur_ocults/pjur_resultats_fitxa?documentId=622795&action=fitxa

Press, A. (2020) Airbnb moves to go public despite pandemic struggles, retrieved on August 20, 2020 from http://www.theguardian.com/technology/2020/aug/19/airbnb-ipo-stock-market

Ragalie, C. and Gallagher, R. (2014) Short-term rentals get 3rd degree from NYC, retrieved on May 5, 2020 from https://www.decodernyc.com/short-term-rentals-get-3rd-degree-from-nyc

Randle, M. and Dolnicar, S. (2018) Guests with Disabilities, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 244-254, DOI: 10.23912/9781911396512–36120

Randle, M. and Dolnicar, S. (2019) Enabling people with impairments to use Airbnb, Annals of Tourism Research, 76, 278-289. DOI: 10.1016/j.annals.2019.04.015

Rettner, R. (2020) US is new epicenter of the coronavirus pandemic, retrieved on November 22, 2020 from https://www.livescience.com/us-coronavirus-cases-surpass-china.html

Said, C. (2014) Airbnb profits prompted S.F. eviction, ex-tenant says, retrieved on April 30, 2020 from https://www.sfgate.com/bayarea/article/Airbnb-profits-prompted-S-F-eviction-ex-tenant-5164242.php

San Francisco Business Portal (2017) Starter kit, retrieved on April 22, 2020 from http://businessportal.sfgov.org/start/starter-kits/short-term-rental

San Francisco Department of Elections (2019) Prohibiting certain campaign contributions, retrieved on January 5, 2021 from https://sfelections.sfgov.org/sites/default/files/20190618_ProhibitingCertainCampaignContributions.pdf

Sequera, J. and Nofre, J. (2018) Shaken, not stirred, City, 22(5-6), 843-855, DOI: 10.1080/13604813.2018.1548819

Sheppard, S. and Udell, A. (2016) Does Airbnb properties affect house prices? retrieved on May 5, 2020 from web.williams.edu/Economics/wp/SheppardUdellAirbnbAffectHousePrices.pdf

Sigala, M. and Dolnicar, S. (2018) Entrepreneurship Opportunities, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 77-86, DOI: 10.23912/9781911396512-3605

Smiley, S. (2016) Airbnb fights ‘draconian’ cap on short-stay rentals in Tasmania, warns of tourism impact, retrieved on November 11, 2020 from https://www.abc.net.au/news/2016-07-26/bid-to-restrict-airbnb-style-home-rentals-under-spotlight/7660982

SSA (2019) Short Stay Accommodation 2019, retrieved on September 22, 2020 from https://planningreform.tas.gov.au/updates/short-stay-accommodation-act-2019

Staley, L. (2007) Why do governments hate bed and breakfasts? The Institute of Public Affairs Review: A Quarterly Review of Politics and Public Affairs, 59(1), 33-35.

Statistic Iceland (2020) Passengers who go through security at Keflavík Airport, retrieved on May 1, 2020 from http://px.hagstofa.is/pxen/pxweb/en/Atvinnuvegir/Atvinnuvegir__ferdathjonusta__farthegar/SAM02001.px/chart/chartViewLine/?rxid=2d6f603d-03d2-4cf7-bbbf-c5ca723a3906

Streitfeld, D. (2014) Airbnb will hand over host data to New York, retrieved on March 26, 2020 from https://www.nytimes.com/2014/05/22/technology/airbnb-will-hand-over-host-data-to-new-york.html

Suciu, A.M. (2016) The impact of Airbnb on local labour markets in the hotel industry in Germany, retrieved on November 22, 2020 from https://ssrn.com/abstract=2874861

Tasmanian Government (2017) The sharing economy in Tasmania, retrieved on May 5, 2020 from http://www.premier.tas.gov.au/__data/assets/pdf_file/0004/318136/Accommodation_Sharing_Policy_Tas_3_2_16.pdf

The New York State Senate (2018) Senate Bill S4899, retrieved on May 5, 2020 from https://www.nysenate.gov/legislation/bills/2019/s4899

Tiku, N. (2014) Airbnb is suddenly begging New York City to tax its hosts $21 million, retrieved on April 8, 2020 from http://valleywag.gawker.com/airbnb-is-suddenly-begging-new-york-city-to-tax-its-hos-1553889167

Transparent (2020) Coronavirus global impact report on short term rentals, retrieved on August 28, 2020 from https://seetransparent.com/en/coronavirus-impact/impact-in-global-demand.html

UK Gov (2016) The rent a room scheme, retrieved on October 26, 2020 from https://www.gov.uk/rent-room-in-your-home/the-rent-a-room-scheme

UK Gov (2018) The rent a room relief, retrieved on October 23, 2020 from https://www.gov.uk/government/publications/income-tax-rent-a-room-relief/income-tax-rent-a-room-relief

Umeda, S. (2017) Japan: Law on renting rooms in private homes to tourists, retrieved on November 4, 2020 from https://www.loc.gov/law/foreign-news/article/japan-law-on-renting-rooms-in-private-homes-to-tourists

Van Heerde, J. (2017) Thousands of houses in Amsterdam are permanently occupied by tourists, retrieved on March 31, 2020 from https://www.trouw.nl/nieuws/duizenden-huizen-in-amsterdam-zijn-blijvend-bezet-door-toeristen~baadec19

Varna Municipality (1896) Варненски общински вестник, Varna Municipality Newspaper, issue 19, 20 June, retrieved on August 22, 2020 from http://catalog.libvar.bg/view/show_pdf.pl?id=1317&year=1896&month=06&day=20&issue=19

Vinogradov, E., Leick, B. and Kivedal, B.K. (2020) An agent-based modelling approach to housing market regulations and Airbnb-induced tourism, Tourism Management, 77, DOI: 10.1016/j.tourman.2019.104004

von Briel, D. and Dolnicar, S. (2020) The evolution of Airbnb regulation-An international longitudinal investigation 2008-2020, Annals of Tourism Research, DOI: 10.1016/j.annals.2020.102983

von Briel, D. and Dolnicar, S. (2021) The evolution of Airbnb’s competitive landscape, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

von Briel, D. and Dolnicar, S. (2021) Activism, lobbying and corporate social responsibility by Airbnb – before, during and after COVID-19, in S. Dolnicar (Ed.), Airbnb before, during and after COVID-19, University of Queensland.

Wachsmuth, D. and Weisler, A. (2018) Airbnb and the rent gap: Gentrification through the sharing economy, Environment and Planning A: Economy and Space, 50(6), 1147-1170, DOI: 10.1177/0308518X18778038

Waxmann, L. (2019) New limits proposed on extended-stay rentals, retrieved on March 27, 2020 from https://www.sfexaminer.com/news/peskin-proposes-new-limits-on-extended-stay-rentals

Wegmann, J. and Jiao, J. (2017) Taming Airbnb: Toward guiding principles for local regulation of urban vacation rentals based on empirical results from five US cities, Land Use Policy, 69, 494-501.

Weiser, B. and Goodman, J.D. (2019) Judge blocks New York City law aimed at curbing Airbnb rentals, retrieved on March 26, 2020 from https://www.nytimes.com/2019/01/03/nyregion/nyc-airbnb-rentals.html

Williams, L. (2016) When Airbnb rentals turn into nuisance neighbours, retrieved on May 5, 2020 from www.theguardian.com/technology/2016/sep/17/airbnb-nuisance-neighbors-tribunal-ruling

Wosskow (2014) Unlocking the sharing economy, retrieved on April 29, 2020 from https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/378291/bis-14-1227-unlocking-the-sharing-economy-an-independent-review.pdf

Zale, K. (2018) Scale and the sharing economy, in N. Davidson, M. Finck and J. Infranca (Eds.), The Cambridge Handbook of the Law of the Sharing Economy, Cambridge: Cambridge University Press, 38-50.

ZwVbG (2013). Zweckentfremdungsverbot, retrieved on March 31, 2020 from http://gesetze.berlin.de/jportal/?quelle=jlink&query=WoZwEntfrG+BE&psml=bsbeprod.psml&max=true&aiz=true

ZwVbVO (2014). Zweckentfremdung Verordnung, retrieved on March 31, 2020 from http://gesetze.berlin.de/jportal/?quelle=jlink&query=WoZwEntfrV+BE&psml=bsbeprod.psml&max=true&aiz=true